Good morning. Happy Monday. Hope you had a nice weekend.

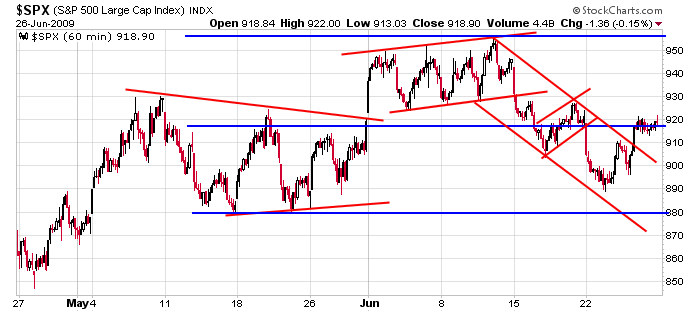

We begin this week much the way we began last week – with the market range bound and in the middle of a 2-month range. In the grand scheme of things, the indexes have acted well. They rallied off their March lows and are now in consolidation mode. For those that watch every tick of the market very closely, there’s been a lot of chopping and churning and very little follow through I either direction. But for those that sit back and look at the bigger picture, the recent action is nothing more than a consolidation period within an intermediate term uptrend.

The breadth indicators suggest some internal weakness, but thus far the market has held up. The upside may be limited until the indicators firm, but this doesn’t mean we should get overly bearish.

The Asian/Pacific markets closed mixed; Europe is currently up across the board. Premarket futures here in the States suggest a gap up open. Here’s the 60-min chart. Today’s open will be near last week’s high. There’s lots of resistance overhead and support down below. With the lack of follow through we’ve been getting and it being summer, keep trades shorter term. Chip away and don’t get greedy. More after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases