Good morning. Happy Thursday.

The Fed is in the rear view mirror. The market tends to reverse whatever reaction it has to the Fed the next day, but yesterday’s reaction wasn’t typical. Normally we get 30 minutes of choppy trading before a trending move materializes into the close. We would then reverse that trending move the next day. But yesterday we got a move down and then a little pop the last hour. So which move is the market supposed to reverse?

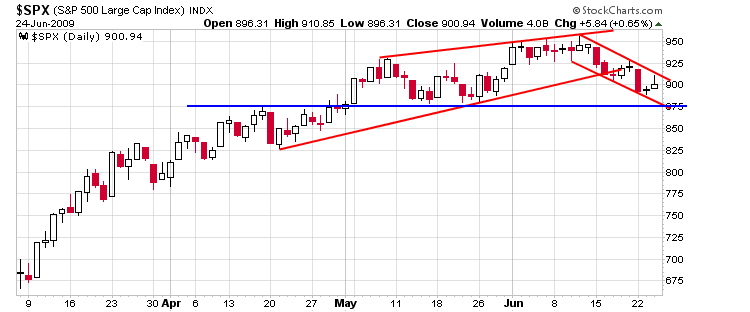

Here’s the SPX daily. It’s not doing too badly. It broke down from a rising wedge, but hasn’t exactly sold off hard or gotten much follow through to the downside. And the pattern of higher highs and higher lows remains in place. Over the last two weeks, the trend has been down, but as long as 875 holds, it wouldn’t be prudent to be overly bearish.

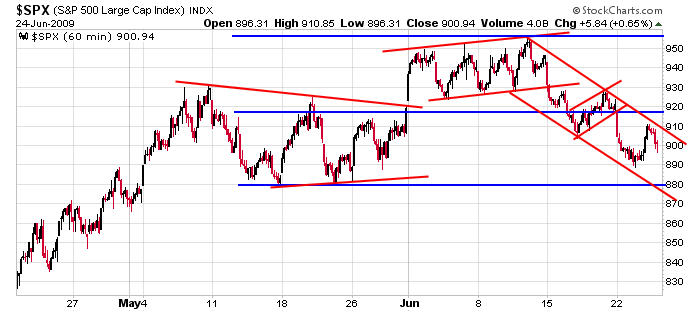

And here’s a zoomed in shot with the 60-min. The index has been range bound for two months.

I’m a trend trader, and right now I don’t see a strong trend to play. More specifically I like to play chart patterns within trends. We had dozens of great plays off the March lows, but now we have to accept that summer is here and we won’t get as many good set ups to play…and we won’t get enough follow through to get us 20% gains. For now we should be more accepting of smaller 5-10% moves. Chip away and play the good ones only. This is all part of the normal market flow. More after the open.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases