Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed – there were no 1% movers. Europe is currently mostly down – there are no 1% losers. Futures here in the States point towards a gap down open for the cash market that will open the indexes near yesterday’s LOD and opening level.

The dollar is up…gold, silver and oil are down.

The big story is in Europe where Greece is feared to be on a path to default on its debt. This would inflict much pain on Germany, France and others who own the debt. The euro is getting hit hard, and as mentioned above, this is causing the dollar to rally which we know is not good for stocks in the US because of the negative correlation between stocks and the dollar.

Pandora (P) is going public today. The company has not turned a profit yet but is still valued at $2.5B. To some degree it’s nice to see the appetite for IPOs, but the increased supply is not something Wall St. can easily absorb right now.

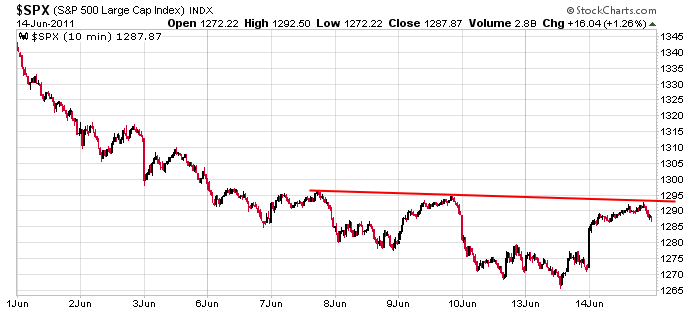

I’m going to call yesterday rally attempt #2. The first one was last week, but that immediately got sold into. Monday’s flat day combined with yesterday’s gap up start attempt #2. I’ve said a few times the last week: “if the market can’t rally when it ‘should’ or when it typically has in the past, the market is in trouble.” If the market can’t rally after 6 consecutive down weeks, there’s a definite character shift underway. Here’s the 10-day, 10-min S&P chart. The bottoming pattern measures up to around 1320.

My stance remains the same. A bounce is due, so it’s ok to take partial profits on shorts, but I’d maintain exposure on the short side just in case a bounce doesn’t materialize and the market melts down. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 15)”

Leave a Reply

You must be logged in to post a comment.

This is the third failed attempt by the bulls to rally

the God damn markets. So Pete, if you’re out there, tell

Ben to pick up the red phone and call the trading room

and tell them to put another shrimp on the barbie

around 1-1:30pm today. Regards, HW

Howard – I’ve been on FED call since the weekend. SUN nite, I had a pizza with Chuck Plosser in Trenton at DiLo’s (he loves sausage & peppers on his thin crust pizza)to see if I could find out “what up” with BEN and the BOYZ. Chuck got a little loose over his third slice and revealed a few hints. Now this is “hush-hush” (the Chicago FED may not know). Lean over while I whisper in your ear.

Seems BEN is having more and more trouble getting the BOYZ to cooperate. Ben wants the bullish “triangle” to stay alive and was really scared about last week’s SPX drop to 1265. He had a secret meeting in Princeton with two of the BOYZ last FRI nite. Apparently, they’re gonna play ball for awhile. Ben wants the rally to exceed 1312 at minimum, with an eye on the 1330-1340 area for wav “D” to give him some time and breathing room. Then another pullback for wave “E” as we head into JULY – to be followed by a summer rally to new highs Neal’s DOW 13,000 I guess). Will the BOYZ play along, or is there more to be made by pushing below 1250 and BEN be damned? I dunno! Chuck seemed anxious and said BEN wants me to find support areas below 1250 – just in case.

There are so many uncontrollable factors out there

that eventually, if the Fed wants to have it’s way,

it is going to have to ‘go with the flow’ instead

of bucking the downtrend.

Oh, before I forget, a new up and coming website

with a strong following is Daneric’s Elliott Waves.

It’s gonna get worse before it get better…. and short the ‘Roo'(AUD) against the ‘Greenback’ !

Aussie Jay

Greece, I was wondering why the Euro was behind the eight ball. It sounds like it’s going to be the USA against the BRIC, technology vs. cheap labor. Maybe we’ll all win in the end. Learn how to use each other’s strengths, live in harmony. Geez! I sound like a Miss Universe contestant.

Jason–great u are realizing usa is not a issolated market in ur commentary

the fed owns massive amts of europe debt by way of being the largest imf contributer

plus many other things such as usa banks—the ecb is also a hair away from being bankrupt

however europe markets not to bad today in a dull narrow range for fri opts

ftse/dax should start to move up in next 10 mins for their close

imo markets have found their range for opts ex fri–but wait till next weeks pos sell off

my nyse tick chart is no where near mondays massive negative tick extremes all day

so no massive selling today

Aussie JAY –im going to hong kong soon to pick up some roos,pands,eagles,mapple leaf gold coins—cheapest place is hong kong for gold coins

You are going to Hong Kong to get one of those

Concubine geisha girls, perhaps? Please get

one for me, too. I’m very lonely here in NYC.

thats when i go to japan–HW

think ill go back to sleep –missed the dayly top,will see if can short some bulls latter on

Neal—id like to get a look at the REAL feds balance sheet

Just as a follow up to my earlier reply to Howard. Chuck just called me and wanted to know if the charts are showing that we’re out of the woods and headed higher. Geez! Looks like the FED has turned all “technical” or maybew BEN is really anxious. But I digress. I emailed him the SPX hourly chart suggesting that the BOYZ may be setting up a “Head & Shoulders” bottom (or not)with the neckline at 1295ish. Now he wants me to show him the damn charts over lunch. I’m getting on the speedline in a bit headed to Philly. Chuck wants to have cheesesteak hoagies by the Liberty Bell. My cholesterol count is going to be way up if I keep meeting this guy. Maybe I shouldn’t have taken this job!

we are in a wave 1 of 3 down,with a piviot at Neals 11300 dji,we can then go up till end aug summer before wave 3 of 3 down

tell ben to buy euros if he wants to change it

perhaps he can buys some pigs–pork bellies are on sale at bargin prices and the tax payers may get some real assets at a bargin

a greek island would be nice

also u can explain to ben what the carry trade is all about and that he needs to raise interest rates to just above japan’s

and how uncle ben has caused this whole mess

we have island reversals with y/days gap up and todays gap downs

but we are still probably in the denial stage with the bulls illusion of fairy tale triangles

“QE2 was nothing more (or less) than another European bank rescue operation!”

http://www.zerohedge.com/article/exclusive-feds-600-billion-stealth-bailout-foreign-banks-continues-expense-domestic-economy-

Since I can’t balance my check book I have no idea what he’s talking about.

you have heard the phase–good money after bad

that why uncle ben was doomed to failure

u need to reward the produceing not the bankrupt hopeless

Capitalize the gain, socialize the loss. What makes you think they didn’t get rewarded?

Even worse Aussie J….Borrowed money after bad !