Good morning. Happy Thursday.

The Asian/Pacific markets closed with stiff across-the-board losses. Europe is currently suffering the same. Futures here in the States point towards a moderate gap down open for the cash market which will open the S&P below yesterday’s low.

The situation in Greece continues to weigh on things, and I don’t think it’s too far-fetched to conclude the market will not move up until a resolution is achieved. Wall St. is good at dealing with bad situations, but it doesn’t like dealing with uncertainty.

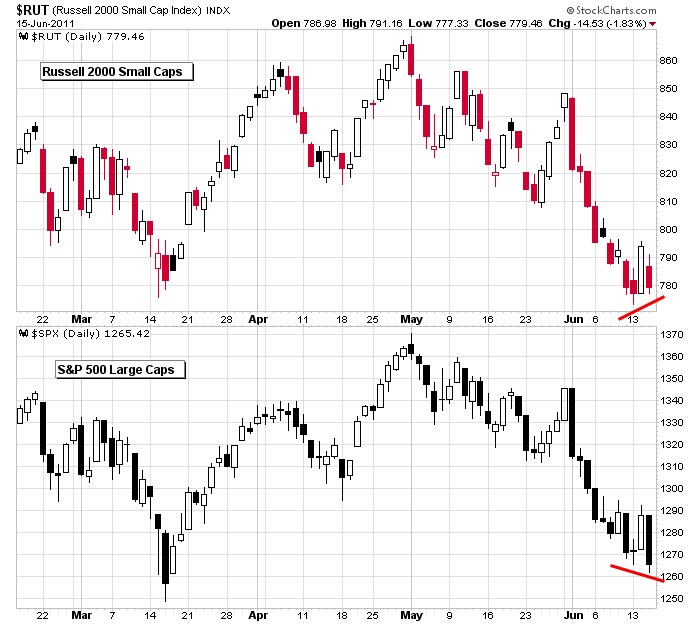

One positive yesterday was the movement of the Russell 2000 vs. the S&P 500. The Russell tends to lead in both directions. If the SPX makes a lower low, but the Russell does not, it’s a good sign. If the SPX makes a higher high, but the Russell does not, it’s a bad sign. Yesterday the SPX made a lower low, but the Russell held up. This type of positive divergence takes several days to fully play out, so the Russell could make a new low today and negate the divergence but at least it’s a step in the right directions.

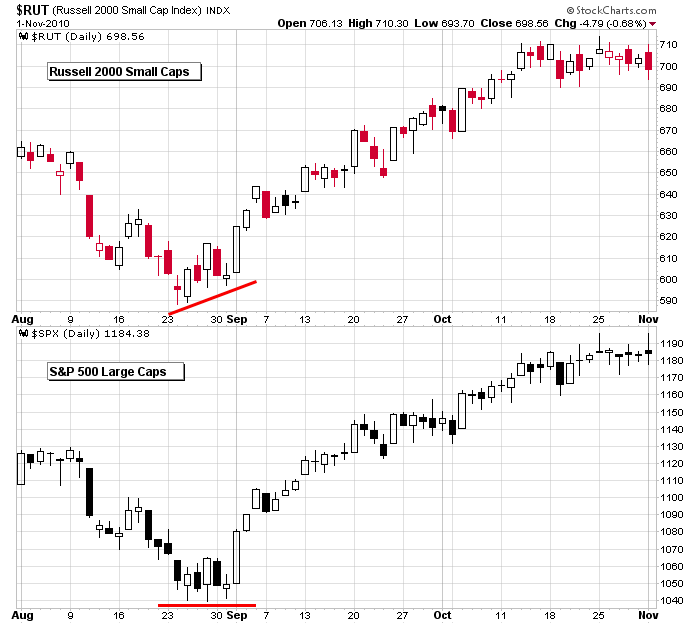

Here’s the chart from August 2010…

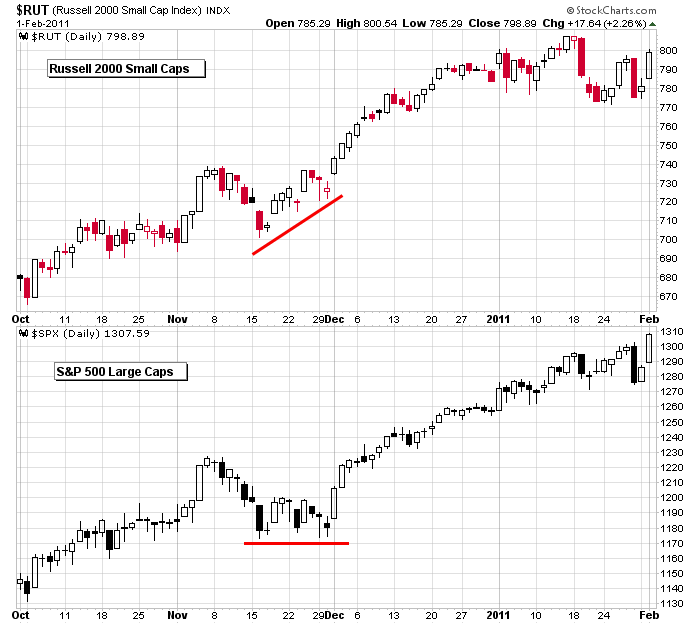

And here’s the chart from November 2010…

And here’s today’s chart…

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 16)”

Leave a Reply

You must be logged in to post a comment.

The RUT/SPX divergence is a very good nugget to acknowledge…

* * * * *

Today is a full moon (+) Bradley Model turn cycle date

according to McHugh’s daily report. Of course EW theory

is skewed to the downside, but, watch out for a mid-day

bounce today, or at least a reversal of some sorts to

happen over the next few days. Maybe resolution to the

Greece crisis could result in a panic up day on Monday.

Yesterday was the full moon and lunar eclipse.

Ummm…so does that mean the Wolves are at the Door ? ; ]

Aussie: you are delayed by 12 hours on this website.

So the next time you go to the bathroom check and

see if you are growing hair in places you’d least

expect it to. Futures now turning positive. 9am NYC

Yes, your site Neal, is truly enlightening, and one does look forward to your insights….

…and you to Howard ;/ & we’re 14/15 hrs ahead as its 1.15 am Fri here….

so now we know the strike prices the instos would like to open for the quad witch dance opts ex tomorrow in the ftse–5700 -dax 7100 –spx,dji,ndx

will go back to sleep now

oh and the 1262 can do as the neck to the h/s but a drop down from the 1270 strike to

below 1250 to trap the bears would go well

imo the 1262 spx rules out the triangula space ship

Good analysis Jason!

I think we are close to a near term bottom. I don’t think we will see the rally resume until fall unless we get a real washout.

Hey guys i did not get the last two days daily email. It is important so check and let me know what happened. Larry Sudderth

You’ve been re-added. Hopefully you receive the emails again.

Jason