Good morning. Happy Monday. Hope you had a nice weekend.

Looks like we’ll start the week on a down note. The Asian/Pacific markets didn’t do so badly, but Europe is down across the board and futures here in the States suggest decent gap downs at today’s open.

The World Bank has cut its 2009 global growth forecast, but this isn’t the cause of today’s weakness. Most of the selling in the futures market took place between 2:00 and 5:00 o’clock in the morning, and the World Bank news didn’t hit the wires until after 6 am.

I’m not going to repeat charts that were posted over the weekend. As was the case last week, the overall charts don’t look too badly, but the breadth indicators suggest some internal deterioration. I’m neutral right now and can make a case for a move up or down.

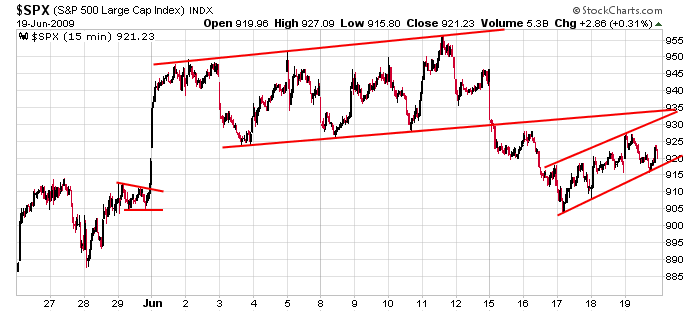

Here’s the 15-min SPX chart. The index broke down at the beginning of last week and now trades in a bear flag pattern which of course had negative implications. If the current futures level holds, the index will gap down to around 914.

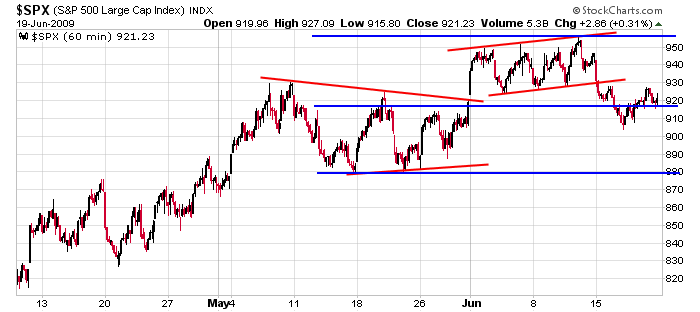

Backing up, here’s the 60-min chart. The index is trading smack in the middle of its 7-week range.

Sometimes trading is easy and obvious; sometimes the coast isn’t so clear, so trading is more challenging. Right now the later applies. Research this weekend revealed a handful of decent set ups in both directions, but not much jumped out as obvious, no-brainer set ups. Be conservative here.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases