Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up; there were several 1% winners. Europe is currently up across the board; a few 1% winners there too. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Gold, silver and oil are up.

It’s obvious markets around the world don’t want Greece to default on their debt and leave the EU because much of the buying today stems from hopes Greece will take whatever measures are necessary to “qualify” for it’s next bailout loan.

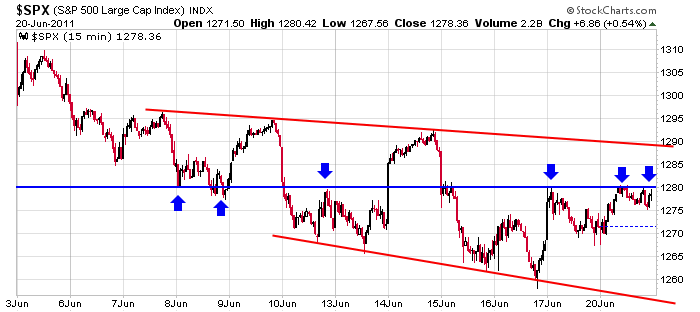

For the last week I’ve said the risk/reward for initiating new shorts was not very good. The intermediate term trend was down (still is), but within a downtrend, there will be mini rallies. If you chase stocks down after they’ve already fallen several days, you could be caught short at the wrong time. This attitude has served us well. We’ve been laying low and letting the market show its cards first. Here’s the 15-min SPX chart I posted yesterday. The 1280 level has acted as support and resistance several times the last two weeks. As of now, today’s open will be near 1285. The real test happens at 1290. That’s where we’ll find out if the last three days have been just a mini bounce within a downtrend or if the move has some legs to the 1300-1310 area.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 21)”

Leave a Reply

You must be logged in to post a comment.

Wait a minute. What’s this about Greece? Everybody is expecting the

market to move on and pop to a new high once the situation with

Greece gets resolved. But nobody, I mean nobody is talking about

‘buy the rumor, sell the news’ type of effect which is altogether

possible when you take into account we need a lot of inertia to

get us into the 1312 to 1315 area. HW

Well,,, start a rumor

I already did. Where were you? HW

That was a rumor?

A lot of ‘Long Tails’ yesterday, I’m bett’n on an up day.

Re: Debt; Jim Rogers is advocating a, “Do Over”

Write off the debt: http://www.wealthwire.com/news/economy/1321

Re: Greece; My concern is the EU, will it hold together

Schaeffers Investment Research has Crocs on their buy list. HW

$SPX 1291.73: Your rumor’s working Howard. Thanks

Dude….we’re already there! HW

BEN bought a pair of Crocs, I’m told. It changes to the same color as his face whenever he gets frustrated with the BOYZ. He’s happy today because the “triangle” pattern is still viable. Chuck phoned me to ask about the “D” wave. I stole Jason’s comments and told him to watch for the 50 day ema currently at 1308 and falling so 1300-1310 will be the target in the short term. I didn’t want to bring up the bearish H&S top with the right shoulder possibly in progress as opposed to wave “D”. Why get BEN upset?

I’m on assignment from Chuck with instructions to find support levels if/when 1250 is broken.

Next time you go to Detroit, there’s only three things

to do there: Greektown! Greektown! Greektown!: Well,

that’s what the people who live there say, as a matter

of fact. HW