Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed mostly up. Japan led the way with a 1.8% gain. Europe is currently mostly down thanks to a profit warning from Philips. Futures here in the States suggest a slightly down open for the cash market.

The dollar is up slightly. Gold, silver and oil are down.

The Greek PM survived the confidence vote. It’s a step, but the country still has to cut its budget and agree to new taxes before getting its next bailout check.

Today is Fed day. Bernanke and Co. will target the overnight rate and discount rate. It would be a shock if rates were changed. The Fed often induces a hiccup in the short term but rarely changes the overall market. I expect the same today. Words are meaningless, but mention of QE3 or no need for QE3 would move things.

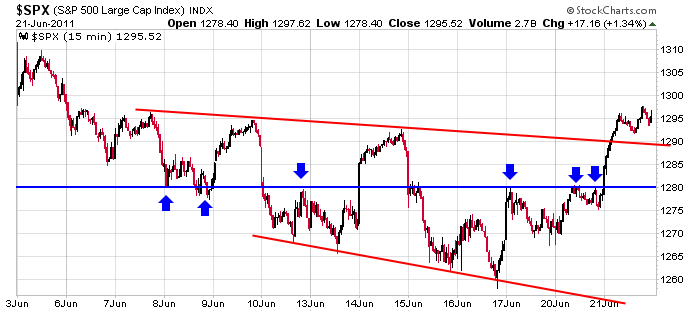

Here’s an update of the 15-min SPX chart. The index easily cleared 1280 yesterday and then sliced right through 1290. That 1290 level could now act as support.

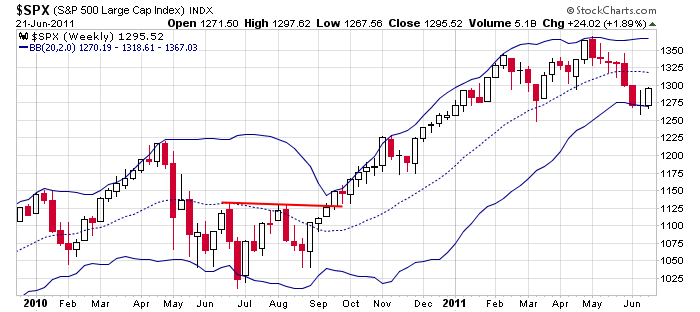

Backing up, here’s the weekly. My target for this bounce is the middle of the Bollinger Bands which is around 1318.

Now we wait for the Fed. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 22)”

Leave a Reply

You must be logged in to post a comment.

How much does a Fed meeting cost? Who pays for it?

Thanks. I guess that’s where I’m getting confused, FED Gov’ment, FED Reserves, they both have the same first name.

RichE: I think you’re getting it confused with FEDex