Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China and India moved up more than 1%. Europe is currently down across the board. Almost every index is down at least 1%. Futures here in the States point towards a fairly large gap down for the cash market that will fill Tuesday’s gap up and put the indexes back in the middle of their ranges.

The dollar is up about 0.6%. Gold and silver are down. Oil is down more than 2%.

The reason for the weakness most likely stems from comments Bernanke made yesterday…that issues the US economy is dealing with may be stronger and more persistent than originally thought.

So be it. We are traders. No sense fighting reality. It helps to not have a strong opinion. Then you won’t be defensive when the market moves the opposite direction.

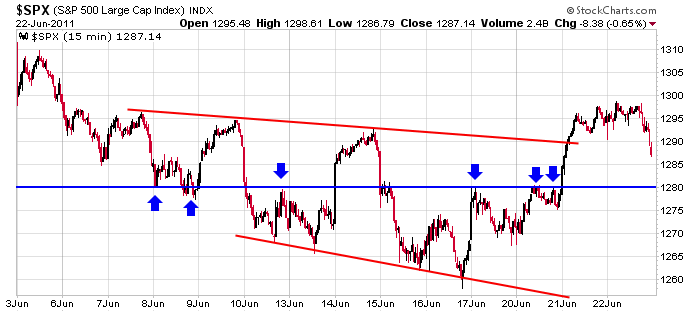

Here’s the 15-min SPX chart I’ve been working off. A few days ago I said if 1280 could be taken out, it would be a quick trip to 1290. That’s exactly what happened, but when 1290 was taken out, we didn’t get much follow through. Today’s open will be back under 1280, so for all the ups and downs the last couple weeks, the next change will be zilch. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 23)”

Leave a Reply

You must be logged in to post a comment.

just closed out all my ftse-dax-ndx-spx-dji at around the spx 1270 premarket cash level

so come on bulls take us the gap fill and main piviot

i want to short some more bulls

Should we nickname you ‘Shorty’?

i have 3 eyes,long purple hair all over,gaigantic sharp claws and all my 10 arms

and when i groulllllllll the bulls go running up the charts

come on bulls just a little further up

my name is shorty and i am a 3 eyed purple people eater

ooops those bulls have run into one of those piviot things

so groullllllllllllll

Shorty the Bull Dog?

Where is Pete M? Is the Fed POMO getting acid indigestion

from the Steak & Cheese hoagies you had a few days ago

in Philadelphia, PA. Howard W

Covered Calls on Collateral Equities

Trading on Friday, June 24th. Don’t be surprised if

we see the Dow up +80 to +100 points sometime during

the trading day. Bulls are not giving up just yet.

I agree. It looks like stealth accumulation. I think I’ll buy a contract just to see if it makes it through the night.

russell is rebalancing or is it overbalanced

opts ex europe tomorrow

Parts 1 & 2 are funny.

Jon Stewart Explains The Greek Debt Crisis. http://email.angelnexus.com/ct/6200880:9126156210:m:1:245173307:1948F45721BCEA1BB2B84C0DA4DBD599