Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mostly down – Australia, Indonesia, Japan and South Korea each lost around 1%. Europe currently leans to the upside, but other than Stockholm (up 0.9%), gains and losses are very small. Futures here in the States point towards a positive open for the cash market.

The dollar is flat. Gold, silver and oil are down but not by much.

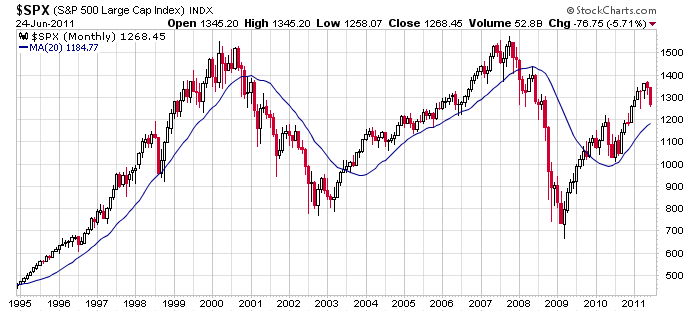

I don’t have much to add to my weekend comments. Most traders are bearish (they should be, the trend since early May has been down). Some are so bearish, they expect the market to take out its March low and completely fall apart. Others believe such movement will eventually play out but are open to a bounce in the near term since the indexes are near support and several indicators are at oversold levels. I’m bearish too, but I don’t think taking out the March low guarantees the market will collapse. I’ve seen too many false breakdowns for me to get overly excited about a huge move down. I’ve seen too many topping patterns that morphed into falling wedges to assume taking out a single level will make all the bulls run for cover. And I also see a support level between 1185 and 1200 on the S&P (see chart below).

You have to be short here because that’s the direction of the trend. But we’re close to a critical level, so I don’t think it’s wise to assume something will happen. The unexpected does somethings happen, so be on your toes. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 27)”

Leave a Reply

You must be logged in to post a comment.

very shortable ,very soon

Short, are we there yet?

We’re a lively bunch today.

indicators change,so must we

I think now’s a good time to short. The ES is hitting 1280.

thats just what i logged on to say Riche,

,but the fed may give it a extra push a bit latter

my stop is a break even,but am only shorting dax and ftse futures atm

we need some negative tick extremes now

Darn! the ES is finding support.

mutual mon they have been buying the rut reweighting and the fed is pushing the banks

one wonders when we will get a real market

on the buy day of the cycle the bears didnt do to bad