Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up, but gains were small. Europe is currently mostly up, but only Austria is up more than 1%. Futures here in the States point towards a flat open for the cash market.

Yesterday was a good day in terms of point movement. Most groups closed up, and many leadership stocks did great. But volume was not impressive.

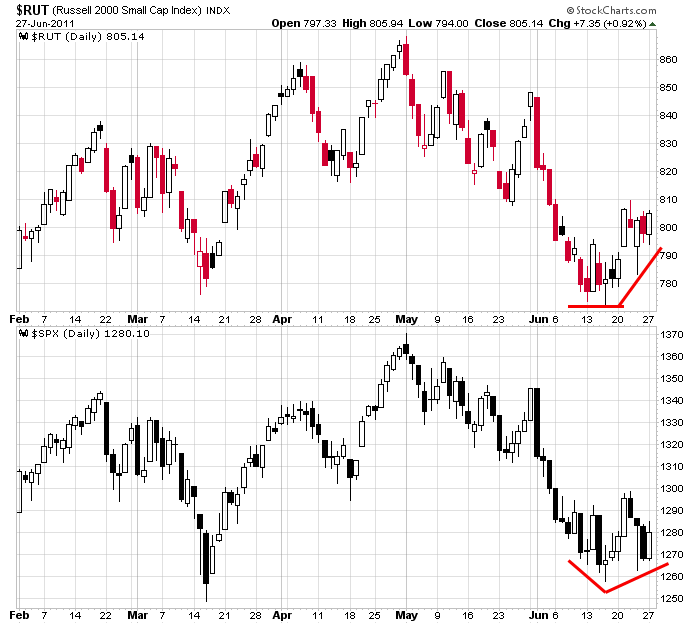

Heading into this week I “warned” to be on your toes. Most market participants were very bearish, but the indexes were close to support and several indicators were at levels that produced bounces in the past. One semi impressive up day later, and my warning remains. Be on your toes. Since so few can envision a rally here, it’s very possible it plays out. Even within a trend, the market likes to confuse and frustrate traders. Here’s an update of one of my favorite charts from the weekend. It’s the Russell vs. the S&P. The Russell tends to lead the market in both directions. Hint #1 that a local bottom was being put in place was two weeks ago when the S&P made a lower low while the Russell pretty much held its low. Hint #2 was last Friday’s candles. The Russell gap up and sold off a small amount. The S&P on the other hand gapped down and almost moved to the previous day’s low. Hint #3 came yesterday. The Russell closed at its second-highest level since June 6 while the S&P rallied nicely but is still lagging. When the small caps lead, the market tends to follow them.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 28)”

Leave a Reply

You must be logged in to post a comment.

as a fundamentalist the technicals have peaked –china has doji’ed

a triangle from june low in industrials–my dead cats are exhausted from eating all the bulls and as a bear i may short the world now