Good morning. Happy Thursday.

The Asian/Pacific markets closed up across-the-board – Australia, China, Hong Kong, Indonesia and Malaysia rallied more than 1%. Europe is currently mixed – there are no big winners or losers. Futures here in the States point towards a positive open for the cash market.

The last three days have been the best 3-day combo since the March low. As I’ve said several times the last two days, this does not look like a dead-cat bounce. Even though volume has been on the lighter side, the vertical move from the indexes and the great performance by many stocks tells me this move has legs – even if the market rests for a day or two.

Isn’t trading fun? How quickly things change…and for no apparent reason. Everyone was bearish heading into this week, but with the indexes near support and several indicators at low levels, at the very least we had to entertain the possibility the market would bounce. How far it would bounce and how long it would last weren’t things we knew, but we had to at least consider the possibility and have a game plan just in case it happened.

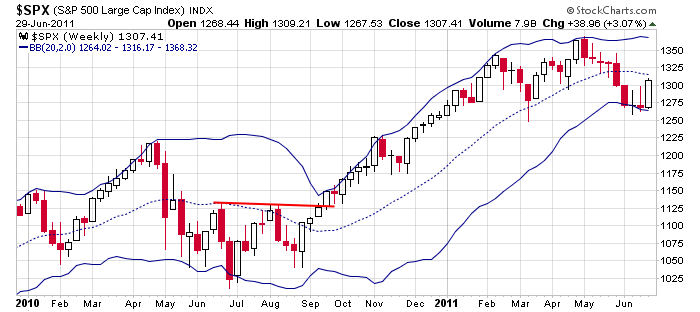

Either last week or the week before (I can’t remember which) I said my target on a bounce was the middle of the Bollinger Bands on the weekly chart. We are 9 points away.

Be flexible, be on your toes. The market is boss. To me, trading is a big game of follow the leader, and I’m not the leader. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 30)”

Leave a Reply

You must be logged in to post a comment.

I agree, this bounce does seem to have legs. Maybe it’s Obama getting tough on corporate welfare.

the bulls are in charge,but divergences are setting up

maybe PeteM ‘s right h/s -shoulder

the priour low is confirmed as genuione

the rest of the day is uncertain