Good morning. Happy Tuesday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed and with a bearish tone, but there were no standout winners or losers. Europe is currently mixed – no standouts there either. Futures here in the States are mixed and mostly flat.

The US dollar is up. Gold, silver and oil are up too.

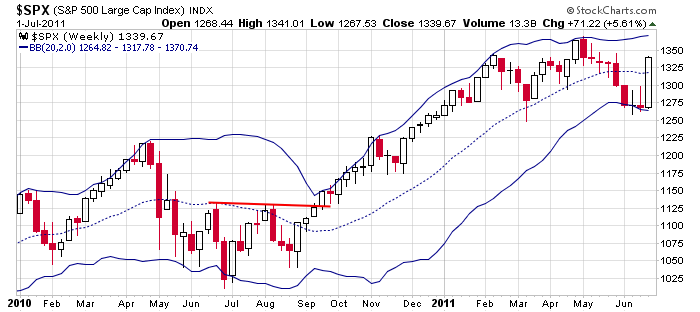

We got the market’s best 1-week rally in a long time last week. The S&P blew through my 1316ish target, so my new target is the upper Bollinger Band – around 1370.

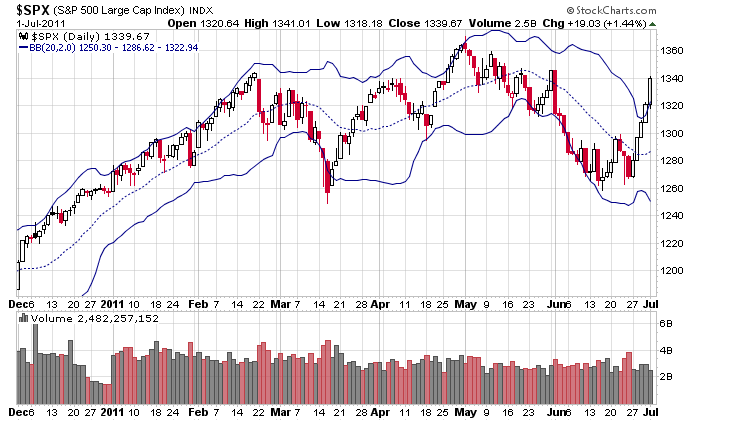

Zooming in a little, last Friday’s daily S&P candle opened above its upper Bollinger Band and then proceeded to rally all day. This happens from time to time with individual stocks, but I can’t remember a time when an index was so far above.

Needless to say, the market is ridiculously overbought on a short term basis. Given last week’s movement and gains from individual stocks, it’s way too late to jump in new positions. Managing what you have and letting the market settle down is the way to go.

I was bearish heading into last week but had offered many reasons the market could rally and warned to be flexible and on your toes. It didn’t take long for me to do a complete reversal. Now I’m bullish, but I still want to be flexible and on my toes. Besides the lack of volume, last week’s movement was suspicious because the indexes slowly grinded up day after day and without any noticeable pullbacks. For some reason there was a constant bid. This isn’t normal, so while I favor the upside, I’m not completely sold. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 5)”

Leave a Reply

You must be logged in to post a comment.

corn plantings surged by around 10% and ethanol subsidies are scrapped despite the upcoming iowa primaries. corn did make a turn, too. does it dive from here? if it does, what does that do to the ag group?

Well, Chuck Plosser from the Philly FED called me this morning to say that BEN is estatic over last week’s rally & feels that the BOYZ will continue to listen to his needs. The bullish “Triangle” (especially in the DOW) is still on track and FRI’s high is ideal for a wave “D” completion with a downward wave “E” to follow, ideally this week. Then, off to new highs and Neal’s Dow 13,000?! The BOYZ have conveniently left open the bearish “Head & Shoulders” formation so that wave “D” could be a completing bearish “right shoulder”. When I mentioned that to Chuck, he responded curtly that BEN is confident that the BOYZ have his back. So, I guess that means that this weeek and next will go a long way in providing clues to the longer term picture. I’m no longer on 24 hour call, which tells me BEN is complacent.

well done Howard

i think u said somewhere earlier

a turn down after lunch time today

can we break fri lows on all indexes

portugal downgraded to junk–suprise/suprise