Good morning. Happy Tuesday.

The Asian/Pacific markets closed down across the board. Hong Kong fell 3%, South Korea and Taiwan dropped over 2% and most of the other dropped better than 1%. Europe is also down across the board. Every market is down at least 1%. Futures here in the States point towards a moderate gap down open for the cash market.

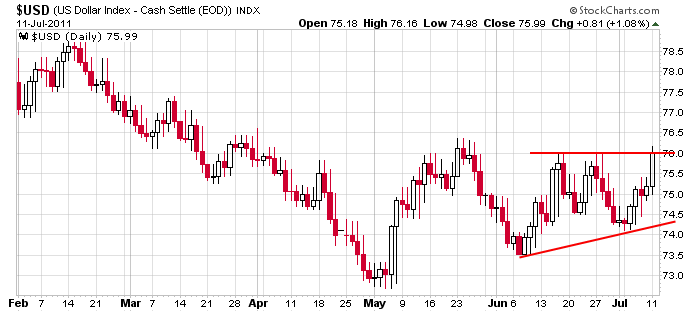

Debt worries in Europe are weighing on the euro which has caused the dollar to be bid up. This is an issue for the US markets because for the most part, the market has been moving opposite the dollar for a long time. Here’s the daily dollar chart.

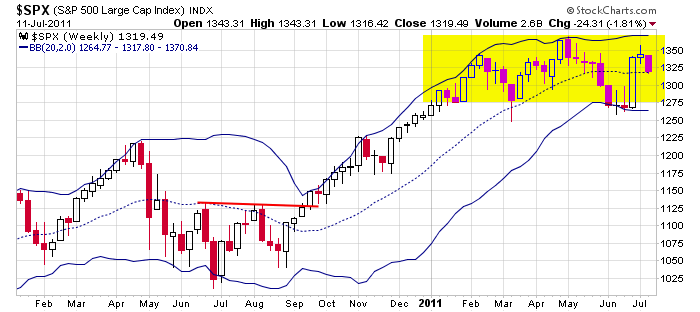

The market goes up, the market goes down. It’s best not to get married to any position or opinion. As I stated over the weekend, despite the recent rally, the indexes have been in a range this entire year, and given the time of year, several indicators being in over-bought territory and the extent of the move, there probably weren’t many investors lining up to buy.

Here’s the S&P weekly highlighting the range. The market has either gone from 1250 to 1350 or from 1350 down to 1250 five times this year. No move lasts long, but we’ve gotten a few nice moves in both directions.

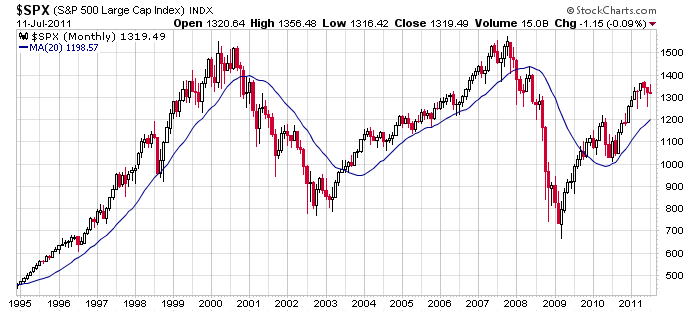

And here’s the monthly which I like to keep in the back of my mind but I don’t trade off of. As long as 1200 holds, I’ll consider the S&P to be in a long term uptrend. But that’s 120 points away, so there’ll be lots of money to be made on the short side if the S&P wanted to test it.

In a range bound market, being ahead of the curve taking profits is usually better than waiting until stops are taken out. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 12)”

Leave a Reply

You must be logged in to post a comment.

The early birds are active this morning.

stay long bonds (new high already today) and metals. i am thinking about whether it is time to switch from the metals themselves into mining stocks. no conclusion yet.

Yep, it’s a bit surreal. Obama needs to bring in the UN Peace Keepers.

Sure wish you’d drop the blow up doll bit, it’s tacky.

Hey RichE: Are you calling Maggie babe tacky?

How would you like to take a trip around the

world with ‘My Maggie” And then you can sign

your name on her leg once the two of you get

back to port, Home Sweet Home. A Happy Ending.

Enough said. I wouldn’t want you to go down the wrong alley.

Just got back from a last minute meeting with Chuck Plosser. We like to meet in Philly near the Liberty Bell and make believe this is still the great country our forefathers envisioned, but that’s another story. I gotta say, I love that monthly chart Jason psoted this morning. I just realized the 20 month SMA corresponds to the 80 week SMA I mentioned yesterday, so I want to give attribution to Jason. Now that’s a great chart for perspective. But I digress.

Apparently BEN got all nerved up again after yesterday’s action. Do the BOYZ have his back or not? To early to tell, I told Chuck. I count 3 “Elliott Waves” down so far with a rally attempt off the 1310-1320 MA support now in progress, so we could very well be looking at an orderly correction that will eventually prove ot be wave “E” of the bullish “triangle” – or not!

tell uncle ben he had better bail out the bankrupt ecb or europe is going down ,pulling usa down to and the books and balance sheets of the fed and ecb and all their crimes will be exposed and the world will know about the bigest ponsi ever pulled and all will end up in jail

today was actually a bearish day ,whilst price was held relative stable the nyse tick was giving negative tick extremes most of the day indicating BOYZ selling