Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up; China, Hong Kong, India and Indonesia each rallied more than 1%. Europe is currently mostly up, but there are no big winners. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down 0.6%. Oil is flat. Gold and silver are up.

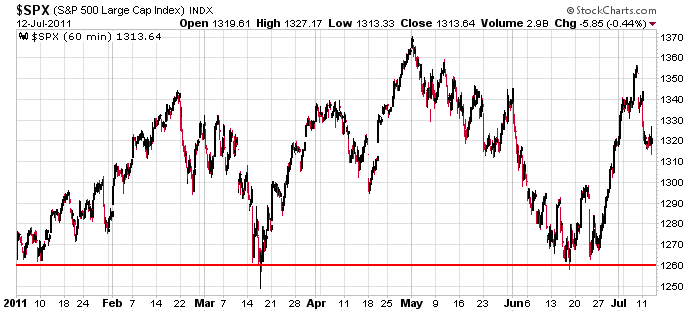

Here’s the 60-min chart since the beginning of the year. We’ve had 5 swings that have gone for at least 80 points. Dips get bought, rallies get sold. In the end the market is up a little, but begin an objective trader has been much better than having a bias and sticking with it. If you’re bullish, you’ve gone back and forth between being happy and being frustrated. Same thing for being bearish. Unless there’s a solid trend in place, it pays to be open minded and flexible.

I remain in wait-and-see mode. To me trading is sporadic; the market gives us unequal opportunities. Sometimes it’s easy to trade; other times it’s not giving us many good pitches to swing at. The latter is the current state of affairs. There aren’t many very good patterns to be had. Fine with me. I have no problem sitting and patiently waiting for better risk/reward set ups and a more obvious near term trend. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 13)”

Leave a Reply

You must be logged in to post a comment.

that looks a little like a cup & handle…..if you measure that does that mean we go to 1460

Yeah, I noticed that yesterday. Hopefully our cup will run over with employment.

stay long bonds, we may be going down to 1% on the 10y and maybe 1.5%-2% on 30y. not sure, but charts and circumstances are conspiring for it. metals are looking delicious too, even at these lofty levels. but remember what the $800 level in 1980 corresponds to today in gold. we are not even close to those heights in inflation adjusted terms.

pump and dump from 13000–eh Neal

are the hedgies long or short from 12900

we need to suck in those mutuals,pensioners and joe six pack

so as we can dunp for the next 5 years

is usa isolationist,or is is this a bankrupt world ecomomy,thanks to ben

we will have a inverted yeild soon as usa is downgraded to junk

I bet gun sales are up.

australia saved the world in the pacific,thats what we are taught at uni

here we go –negative tick extremes—a daytraders dreams

What symbol and time frame do you use for TICK? I couldn’t make it useful. Thanks

RichE

Go to http://www.redliontrader .com

and look under indicators–it tells u how to load it use it and trade with it

its the only indicator i have found that is infront of price by 1 min in some cases

i use it on my 1 and 5 min charts

Thanks. I use KH and KVO on 5min (13,34,55). They’re the same indicator. KH is a histogram and KVO is lines.

where do i find info on KH

instos are definitly selling into strength–per my tick ind

Neal

piviots are a absolute must for trading as they are what the instos use

new piviots come on my esignal charts automaticly at midnite ny time,together with

previouse days high low close

after close of trading today i will turn my charts from 1 and 5 min to daily /weekly ect and see what that produces

the only one thing i am better at than speling is mathymatics

bloomberg –just now–if inflation goes up –uncle ben would be forced to raise rates

and likewise if overseas looses faith in usa and bond yeilds go up

sir ben would be forced to raise rates–just look at greece

uncle ben –i dare u –QE3—that should kill the banks and usa

as a perfect being –i cant change either

as a infinite,imortal being i have no matter energy time or space

but instead create those in order to have a game

change equals time

just having some fun with time