Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed – there were no standout winners or losers. Europe is currently up across the board – France, Germany, Stockholm and Switzerland are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

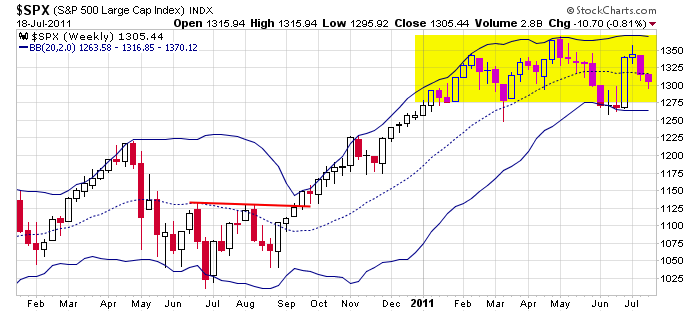

Yesterday, all the indexes hit a new July low and closed at their lowest level since late June. Some key groups such at the banks and semis hit new lows for the year. As good as things looked three weeks ago, they look equally bad right now.

The debt ceiling debate lingers, and when it gets resolved, the market is likely to move quickly. Wall St. wants the ceiling raise because it doesn’t care about the debt; it just wants money to keep flowing. So raising the ceiling could result in the highs getting tested again. It doesn’t mean a lasting rally will begin, but there should be enough buying pressure to get the indexes back to their recent highs. Failure to raise the ceiling could cause big time selling pressure…unless that scenario is slowly being discounted. In any case, we have a major news event pending, but we don’t know when the news will hit or what the news will be. Lots of unknown event risk to say the least.

This is one reason I am laying low. I plan on trading for a long time, so I don’t mind missing a week here or there when there aren’t many good set ups, the risk/rewards aren’t great and a major news item that has the ability to jerk the market in one direction or the other lingers. The market, after all, has been range bound since the beginning of the year, and right now we’re in the middle of the range.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 19)”

Leave a Reply

You must be logged in to post a comment.

pump and dump volitility insto distributation

the market is to big a hot pottato for the instos and they are going to take Jasons advice and lay low with their hedged shorts

Wake up! Zen Master, Wake up! The days of ‘buy and hold’

are long gone. The name of my new website is: alphadow13000.com

Aussies’ don’t eat Sharks !

Hello,

My name is Jim Bergen. I’m from Forexpros, the Finance Portal. I’d like to invite you to have your analysis published on our site as a featured analyst. This would have benefits both you and Forexpros.com. If this sounds interesting, please email me at Jim at Forexpros.com.

Thanks,

Jim

Jim…email the site for such inquiries.

Jason

daytraders look for scalps

Yesterday, the SPX failed to accelerate through 1295+/- (Neal, please don’t read this as I know how upset you get – it’s just my take based on how I trade), so the “E” wave of the potential bullish “triangle” may be completed and today’s upside gap open could confirm it if it remains unfilled. From my trading perspective (longer term), this could be a good place to add long positions with an exit if yesterday’s low gets taken out. Jason mentioned a few week’s ago that the structure of any pullback off of 1356 would be a key to the bull case remaining intact. My take has been that the pullback has been “corrective” and not “impulsive” (once again, I’m sorry Neal for writing this way and not talking more about “pivot points”, etc). Can we still see DOW 13,000? I dunno, but if APPLE was part of the DOW – well, you know what I mean.

AS HO, Sensei! Then the Perfect Master thinks “Head & Shoulder” to lower first, before higher!? AS HO, Sensei!

What cryptic language is this? Are we now

reverting back to animalistic tendencies?

Howard, only a Sensei would know this language and its deeper meaning because a Sensei (aka Perfect Master) knows all. The only possible exception may be MAX!