Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed and perhaps with a slight upward bias, but China dropped 1%. Europe is currently mixed; Stockholm is down 1.3%. Futures here in the States point towards a positive open for the cash market.

After recapturing 5 days of losses in a single swoop, the market rested yesterday. Overall it’s done a nice job holding up when many thought it would cave in. The week began with the indexes near the mid point of their June low and July high, and right now it’s near the mid point of its July low and high. Rallies get sold, dips get bought. In the end the market hasn’t moved much since mid February. It pays to be open-minded and flexible and to not harbor strong opinions.

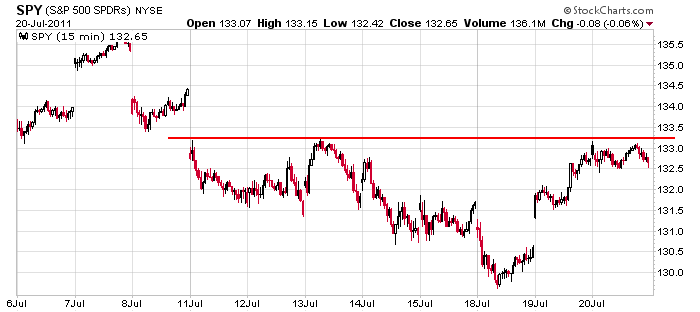

Here’s the 15-min SPY chart…an 8-day base with two relatively large gaps overhead. The fun begins when resistance gets taken out. We either get a quick 10-point S&P move up or we get a false breakout and at least a 10-point drop. I’m of course just talking to short term traders.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 21)”

Leave a Reply

You must be logged in to post a comment.

Thanks Jason

europe is very volitite today –so is euro

Attn: Day Traders: Wait at least 1/2 into trading

today before making your first move. In fact,

you have time to go down to the grocery store

get some Foster’s Lager come back and execute

your first trade of the day. HW

HOWARD

u cant trade when ur drunk

u wont know if ur pushing the buy or sell button

hey aussie, ive been reading your comments for a while , and as im just learning about emini day trading etc. how did you learn to trade? can you recomend any training sites? and do you do it full time.

thanks

mac

Aussie, I use mental telepathy for day trading.

Works like a charm let me tell you, brother!

If the bullish “triangle” is in play and wave “E” ended on MON, it appears that the DOW may give the first hint that we’re headed to new highs in the major averages. A break above 12,753.89 will clear the trendline drawn from the MAY high down thru 12,753.69. In that case, we may see (gulp!) Neal’s Dow 13,000! OH, MY!!

Chuck Plosser (FYI NEAL, he’s head of the Philly FED) tells me BEN is ecstatic at the possibility of new highs and is convinced he has the BOYZ’s support whenever needed. I mentioned to Chuck that “triangles” usually precede the final top of an upward move. He told me that BEN will worry about that if/when the time comes. Chuck thanked me for my service and terminated my Philly FED “technical consultant” contract, effective on FRI’s close of trading. It’s just as well, as those Philly cheesesteak lunches with Chuck were killing my cholesteral numbers.

I’m now waiting for the BOYZ to spring the “pop & drop” and signal they’re getting short for the longer term. Until then, I remain long & strong with long term sell stops on a close below MON’s low.

Kudlow lives a few blocks away from me on Park Avenue

here in NYC and Melissa Francis, (also from CNBC) lives

two doors down from me. HW

OK

the pop and drop may be about to happen

we have tick divergence to price

but a lower double top at 12761 dji would look good

go the bulls

Go out 60 days and the dbl.top looks like a handle on the cup or maybe beer mug.

“A blow off rally” before the correction.

Ron – there do appear to be longer term bearish divergences that may accompany a new high. I’ve also learned through experience that there can be a “triangle failure” (think of it as an “erectile dysfunction”)where the breakout fails to follow through and reverses down thru the bottom of the “triangle”. Of course, the BOYZ and the HFT crowd never pay attention to charts and technical indicators, or so says our Sensei, Neal. But, it is uncanny (in my opinion) how often patterns appear to be completing or have completed, only to see a violent move in the opposite direction. Which is why trading the right “size” and exercising sound money management through “stop loss” discipline (even our Sensei should agree with that) is the most important thing I’ve learned in forty years of trading, regardless of trading style.

I sure hope this gets resolved to the upside and then I could afford an imported beer.

I’m looking at 1340 on the ESU1 as the line-in-the-sand.

BTW: Good call on going long this morning Howard.

if todays lower double top in the dji holds ,then it is a very bearish event

and would indicate wave 2 of 3 had ended and we were headed into impulsive wave 3 of 3 down

Wait for confirmation before you go short.

The asshole Obamarama may even push for

the Dow 13,000 before we start to go down.

(It won’t be too hard to do that considering

the fantastic clip we are proceeding).

ndx has triple topped

the markets are exhausted and will rest now

the euro is in rig a mortis