Good morning. Happy Friday.

The Asian/Pacific markets closed up across the board. Australia, India, Japan, Singapore and South Korea rallied more than 1%. Hong Kong gained more than 2%. Europe is currently up across the board. Gains are moderate; there are no 1% winners. Futures here in the States are flat.

It’s been a very good week for the market. At Monday’s open, the indexes were near the midpoint of their y-t-d range, but solid up days Tuesday and Thursday have put them much closer to the top of their ranges. On a closing basis, the S&P is only 10 points from its high from two weeks ago and about 20 points from its April/May high. That’s not bad considering the market was supposed to fall. 🙂

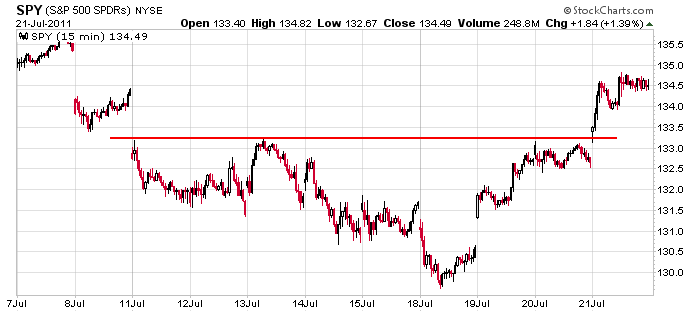

Here’s the 15-min SPY chart I posted yesterday. It took out resistance and quickly filled the July 11 gap down. Now it’s consolidating just below the July 8 gap down.

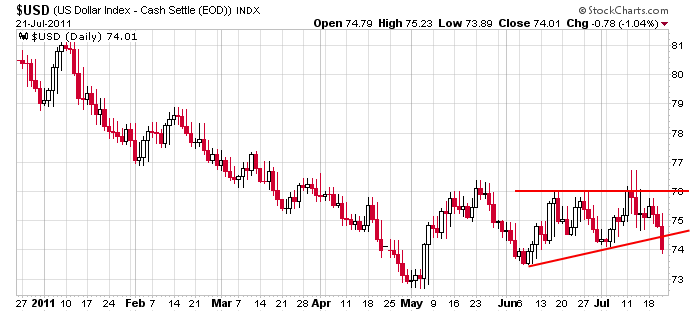

The big news out yesterday was the dollar. It got hit hard, and as we know, it’s been moving opposite the market (or the market has been moving opposite the dollar). As long as the dollar is weak, large, multinational companies will benefit from a favorable exchange rate, and since these said companies are the ones that control the indexes, the market in general should have a steady bid.

Overall the market is still neutral and range bound, so don’t get too giddy about the prospects of a breakout. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 22)”

Leave a Reply

You must be logged in to post a comment.

the irrational exhuberance of the week has given us bears plenty of fooder for the long hot summer–but where are we going to put all the bulls in this heat after we have scalped them

should be the teddy bears picnic today

ive just closed out my preopen shorts for the 2nd time and waiting for open

hey aussie, im just learning emini trading can you recomend any courses or sites you use?

thanks mac

my emini teacher is not taking anyone new

but i have done the pattern trapper course ,thanks to Neal

and i can recommend that

http://www.PatternTrapper.com

apart from that i would need to know more info about u

u can also try barry burns –Top Dog trading,but havent done his course

–some sites for news letters dayly reports marty chards –www.stocktiming.com

as for indicators –there are many sites

but Jason gives the best overall view imo

Neal,

Aaron from learnemini.com,but its a closed site

we used to have a open room where a group of 20 or so would trade with him all nite

with his and our charts open on esignals and orders through ninja

but because of his health he cant trade all nite now –yes hes a aussie trained by the big boys in usa

now hes taught us fx and opens the room for a few hours at europe open to trade the euro

hes also now just teaching us a long term investment couse on where to put our long term money and cycles of when to move it in /out of differnt things

yeild spreads-bonds currencies ect

piviots–i dont know how to calculate them –u will have to do that

i just know how to use them real well –they together with the tick are the magic

we are all stalled out at the main piviot atm—took profits on dji -spx ftse dax shorts

even the euro is stalled out at main piviot

i just love scalps

but looks like it will break through piviot to down

when /if it does i will take more scalps

the dji is the weakest –so more weighting to that–its testing the main piviot from below–the rest have used it as support

the tick is telling me that with a negative tick extreme at the main piviot,that now with the tick for last 2 hours is trading mostly in the bullish positive zone above zero line —-that the character of the market has changed to up

but it is very slow —im going to sleep now for 2 hours

was today a consolidation for a move higher or start of a move lower

Neal———-a bit late for this post of mine—-its now 3.30 pm aussie sat my time

firstly –may i say its absolutely essencial for anyone trading the emmis to have piviots on chart as these are what the instos use to place their buy/sell orders

now if your platform doesnt already have the piviots as a ind that u can download already calculated piviots,then u would have to calculate them ur self

ur site or hunts will let them do that or the well publised formular is available elsewhere

in esignal platform they have the piviots as a download you can add to ur charts

under the formulars sect

i get mine as a proprietory indicator from my current emini teacher which inc prior days high low close automaticly uploaded on my esig charts

i did like hunts optional half day piviot extensions

Hunts offer a indicator package that can be downloaded that includes piviots already calculated

cheers –john