Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Europe is currently mostly down, but there are no standout losers. Futures here in the States point towards a negative open for the cash market.

The dollar is up slightly. Gold and silver are up slightly. Oil is down 80 cents.

Another day has passed and still no agreement in Washington regarding the debt ceiling and such, so for now the market will remain hostage. Prices have drifted down this week on light volume. Wall St. doesn’t like uncertainty, it doesn’t like being left in limbo. Wall St. is pretty good at dealing with “stuff,” but when it doesn’t know what that stuff is or will be or when it will happen, prices generally move down as traders take conservative, wait-and-see stances. That’s what’s been going on, and that’s what I suspect will continue to be the case until there’s some sort of resolution. Of course once some sort of resolution is a agreed on, August will be here – the slowest month of the year, the month traders typical take breaks before fall.

There have been so many reasons the market should have come down hard this summer, and here we are, in the top half of the y-t-d range. Why haven’t the bears been able to take control?

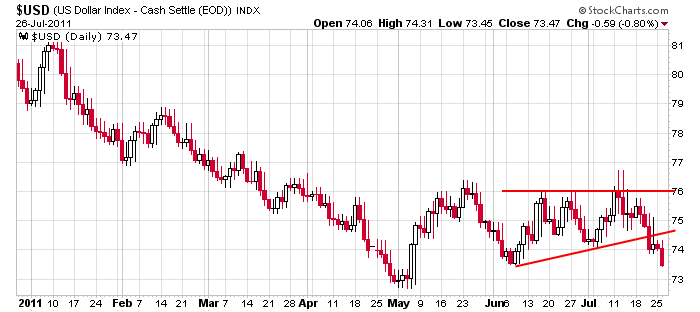

One reason is the dollar. It’s down about 10% since the beginning of the year, and as long as it stays weak, the market will a little bid under it. Of course the gains aren’t because companies are growing organically, it’s because they benefit from a favorable exchange rate. Here’s the dollar chart. I remain in conservative mode until things clear up.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 27)”

Leave a Reply

You must be logged in to post a comment.

obarma and boringer are bollywood movie stars working with bernickie to send the usd down

but when usa bonds are rated as junk interest rates will be rising and yeilds high and inverted–long before that the carry trade using the usd will have repatrieated back to usa forcing the usd back to 80c and bernickie will have dirty pants

They are flying AussieJS in from Australia

to play the stunt double of Tim Geithner

when he vacates his role shortly. HW

oh no

the current sideways to negative in many stock indexes is consistant with the right shoulder to a h/s

Aussie…..go to the bathroom now! When you come back

we’ll be flash crappin..err..I mean flash crashin! H

bonds are down a tad despite crashing stocks this morning. don’t be fooled by the default talk, stay with long bonds as well as metals. always look at the magician’s hands, not his lips. p.s. wouldn’t it be funny if the grand old usa defaulted before one of the piigs did? 😉 not haha funny, but still..

Given today’s action, I just want to follow up on my comments from yesterday about NDX. In my opinion, all the elements necessary to call for a completion of the “ending diagonal” I referred to are there on the hourly chart to see. Today’s downside gap opening and run to the downside is typical of what follows the completin of this patten. Therefore, if that’s what we’re seeng, we should expect further downside action to the 2320 area. From a longer term perspective, if this downside move can be confirmed as “impulsive” we may have a fullfillment of the 6 month widening wedge (megaphone) pattern signifying that the move from early 2009 is over. If that’s the case, subsequent rallies can be sold with an appropriate money management stop loss.

Thanks for your comments Pete.

the jaws of death are closing

roast uncle ben for lunch

my jaws of death ndx 100 go from the may high and low expanding out

and the bottom line looks like ndx 2172

correction to that feb high to low