Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Australia, India and Japan lost more than 1%. Europe is down across the board. Austria, Belgium, France, Germany and Stockholm are down more than 1%. Futures here in the States points towards a flat open for the cash market.

The dollar is up. Gold is up slightly; silver is down. Oil is flat.

I don’t have anything to add to the comments I made yesterday after the close. Wall St. doesn’t like uncertainty; it doesn’t like to be left in limbo; it doesn’t like to guess. It can handle almost anything you throw its way, but it needs to know what’s being thrown at it and when. As long as Wall St. has to wait, prices will not catch a bid, and as the debt ceiling deadline approaches, the urge to reduce risk increases. Hence the selling.

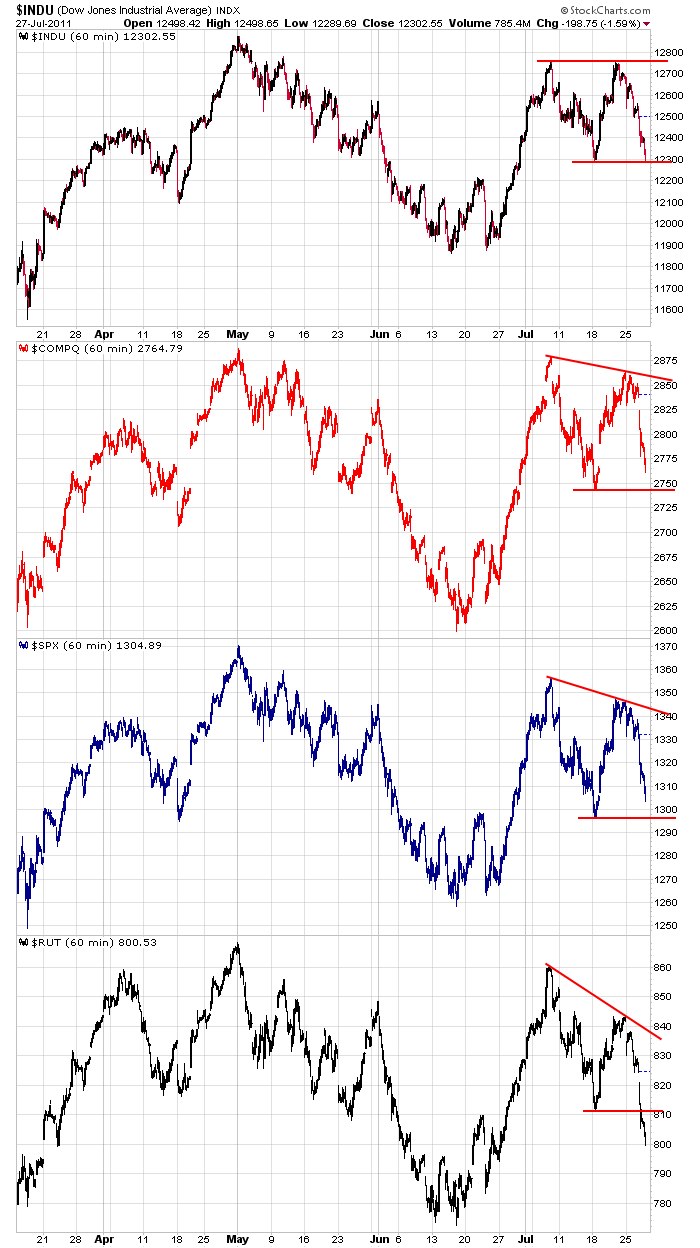

Small caps tend to lead the market both up and down. When the market does well, the small caps out-perform. When the market is weak, the small caps under-perform. Lately they’ve under-performed. While the Nas 100 made a new high and the Dow nearly matched its high and the other indexes got close, the Russell small caps did not. Now on the way down, all the indexes have held their previous lows while the small caps have made a lower low. I’m sure some of the under-performance is due to money rotating from the small caps to large caps with the uncertainty looming in Washington, but regardless of the excuse, it’s still not a good thing.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 28)”

Leave a Reply

You must be logged in to post a comment.

“prices will not catch a bid” What does that mean? I thought BID was the sell price and ASK the buy.

Nope.

Maggie burns easy in the sun. Now an African-American

version of her would be a plus because I could take

her to the beach. HW

Go stand in the corner Neal

I don’t buy that idea at all. The economy and the market are already in trouble, so what the Fed or Congress or the Senate or President does, is not going to change things Long Term. The Economy is way bigger than anything else, and nothing they do will change things in the long run, unless it is large structural change (won’t happen soon as they are not even thinking about it) and much lower regulation. Have not been on here posting but I have said to close friends for years now that our overpaid workforce, forced on the economy by the unions going back some 50 years or more, was a major cause of the rising salaries and benifits, cost of goods and on and on. Couple that with the Greenspan years of lower interest rates, actually ZERO rates, and the policies in Washington DC to allow the less wealthy to buy homes they could not afford, and we have the problems we have today. More than that really , but that is good for starters. The point is, this has all brought on Bubble after Bubble. Where does it all end? I suspect in a dire situation for the US. We are just now seeing the start of the crumbling of America fueled by excessive private and public debt which will take many years to dig out of. This will likely not end pretty, and there will be allot of unhappy people in this country. The spending will stop eventually, either by policy change, or by the force of nature, but we will likely see allot more unemployment and under-employment for years to come. Likely home values nationwide will continue the slippery slide down.

I have NO Faith that anyone in the House, Senate or Presidency can solve the problems currently. It will take a whole different mindset that is not fully in DC yet, only a little bit. Hopefully that will change. Some of the slime there now is disgusting to watch.

“Change We Can Believe In”! What a Joke. Those words will be eaten for sure.

Is this bullish or bearish for AAPL? Yesterday, I heard that, with the exception of 2 analysts, remaining analysts following AAPL rated it a buy with the stock trading around $400 with a projection of $500. The other 2 analysts rated AAPL a hold. Now, look at the daily chart of AAPL and note the upside gap from last week that remains unfilled. I’m not predicting anything but there’s trendline support from the JUN low around 385. A gap below that level could leave an “island top” formation in place leaving the late Bulls trapped as they assumed $500 was a lock. I’m just sayin’….

just woke up –suppose i cant sell till those gready ,lazy yanks vote –or can i

the bankrupt want more credit——————–just say no

handsome gains in equities all evaporated in before the close (except for NQ, which is holding on to some of it). starting to feel a little uneasy out there. with the fall approaching fast, we need to make clear new highs soon. or else..

bears are big bears are good

bears dont take entilements or food stamps

bears are wise bears are productive

——-just say no to walls street———–