Good morning. Happy Wednesday.

The Asian/Pacific markets closed down across-the-board. Australia, Japan and South Korea lost more than 2%. Europe is mostly down. Amsterdam and Stockholm are down more than 1%. Futures here in the States point towards a slightly positive open for the cash market.

It’s been nothing but solid selling pressure this week. When added to last week, we have 7 consecutive down days for the S&P and lower lows for the Dow, S&P and Russell small caps.

Several indicators are at extreme levels…the 10-day of the NYSE AD line, AD volume line and 52-week new lows are at new lows. The average true range is moving straight up. Sentiment is terrible, and many individual stock charts have completely broken down. From a technical stand point, the market can’t rally from this position. Too much damage has been done. Charts will need time to set up. The Fed could always step in as they’ve done in the past, but that’s not my game. I don’t take positions under the assumption the government is going to save the day.

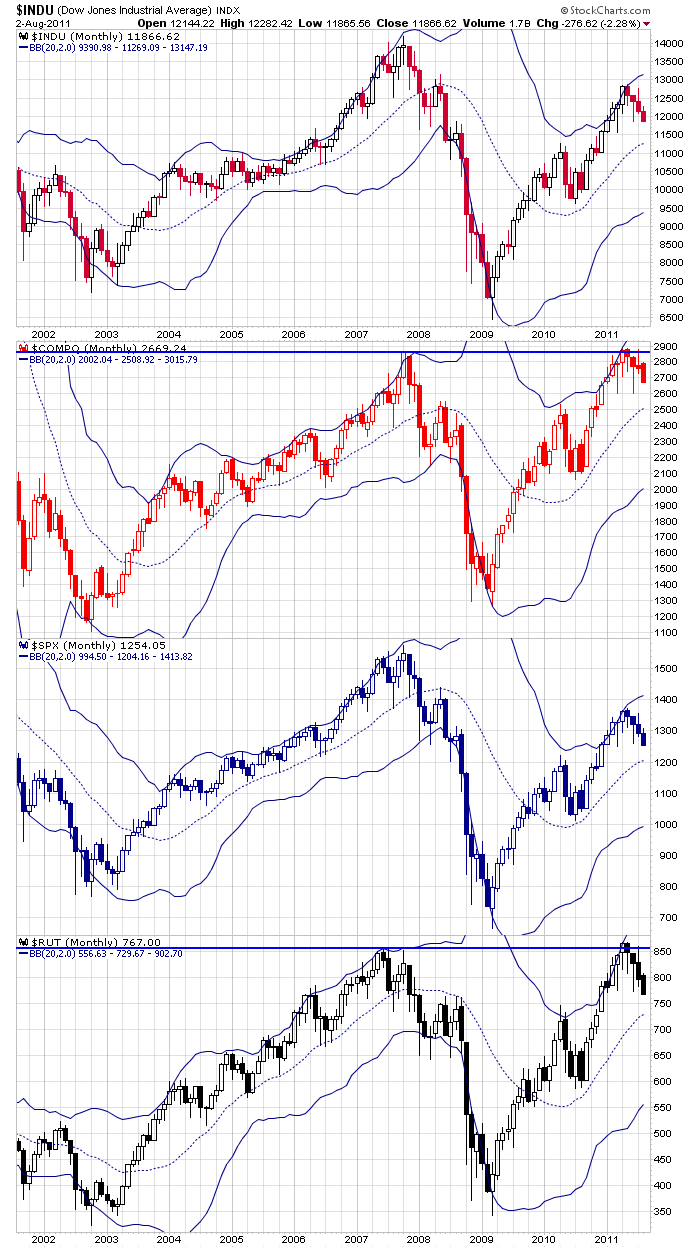

My downside targets are the middle of the Bollinger Bands on the monthly charts which is also the 20-month MA. For the S&P that means 1200 – now only 54 points away (two days ago it was 90+ points away). Here are the monthlies…

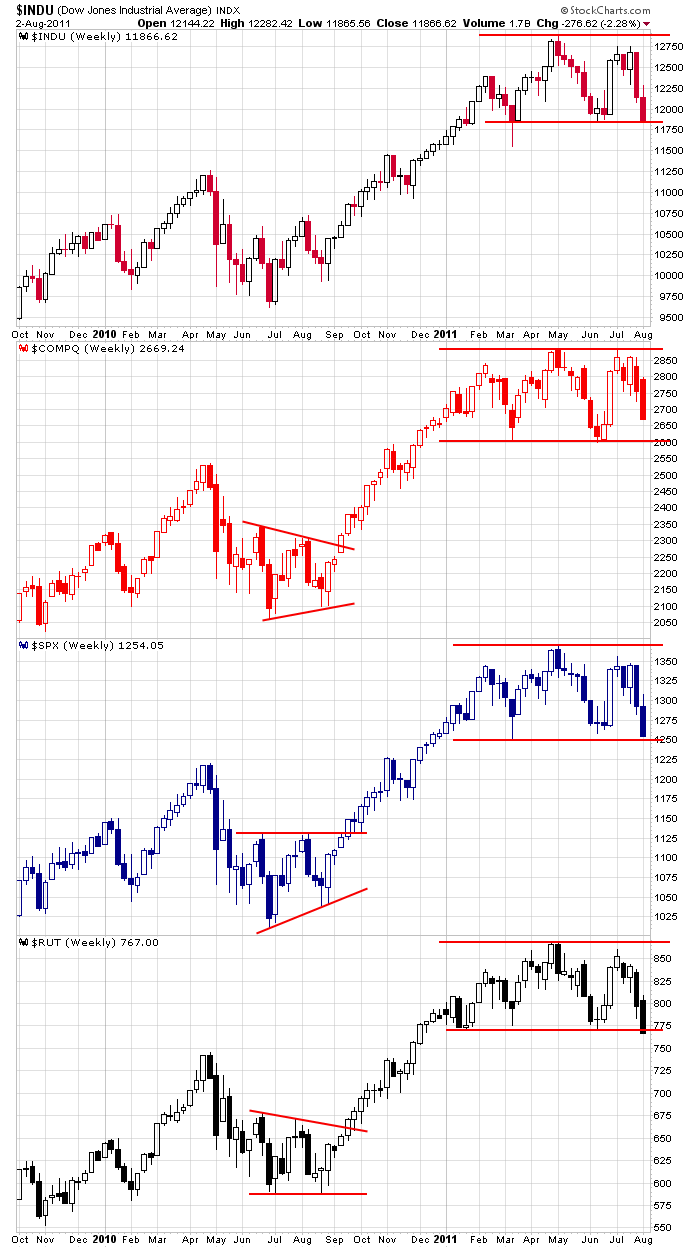

The bulls can hang their hats on two things. 1) The market is in horrible shape right now, and it’s at times like these when the world is caving in that the market can surprise everyone, and 2) Even though the several indexes have made lower lows, the indexes are still range bound (with a little room for error permitted). Here are the weeklies…

In most cases it’s too late to go short…start building your list for the next bounce.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 3)”

Leave a Reply

You must be logged in to post a comment.

we look very overbought here compared to the 2008-9 red candles on ur chart

just a simple observation from a simple person

Lower lows on the Russell. Ominous?

the fed may close its shorts anytime now to pay its interest bills

long TF @750 even, out a few more ZB contracts, holding on to all gold and silver positions for now.

Did you dive in or were you pushed in?

imo the fed still has a broken neck even after it closed its shorts

ftse may find s/term support at 5500

dax is weak

buyers are weak

come on bulls –i need something to short

if buyers cant get above main piviot –this is not good