Good morning. Happy Tuesday.

Yesterday the market closed within the bottom 20% of its intraday range, so odds favor yesterday’s low being taken out.

The Asian/Pacific markets closed down across the board; Europe is up across the board. Futures here in the States suggest a gap up open.

There are lots of smart market operators out there that have differing opinions right now. Some say we’re heading to the March lows and lower; others say this is just a correction – some summer selling – on the way to SPX 1000. I’m neutral here. I don’t make money making predictions. I make money recognizing what’s happening and going with the flow. If you run a billion-dollar hedge fund, you might have to be pretty good at figuring out what’s ahead because it may not be so easy to get in and out of the market, but I’m a small fry compared to the big players and banks on Wall St. I could be in cash of be fully long or short in a short period of time. Therefore I don’t have to predict. I can react to what’s happening rather than predict what’s happening.

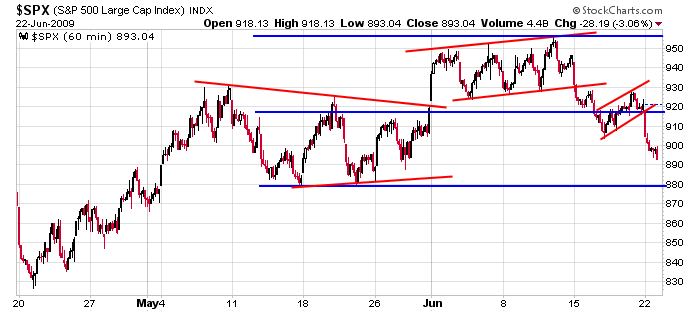

Right now my bias is to the short side. If the indexes are a function off all the sectors that comprise it, there are too many sectors breaking down from topping patterns for me to believe buyers will be able to halt the selling pressure before a significant support level is approached. Here’s the SPX 60-min chart. I expect 880 to be tested. Then we see if the bulls have anything left in the tank. More after the open…

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases