Good morning. Happy Thursday.

The Asian/Pacific markets close mixed. Australia, India, South Korea and Taiwan lost more than 1%. Europe is currently mostly down. Austria, Norway, Stockholm and London are down at least 1%. Futures here in the States are down a bunch. About half of yesterday’s move off the lows will be wiped out at today’s open.

The US dollar is up over 1% and trading at its highest level in 10 months. Gold and silver are up slightly. Oil continues to slide and is down to $91.

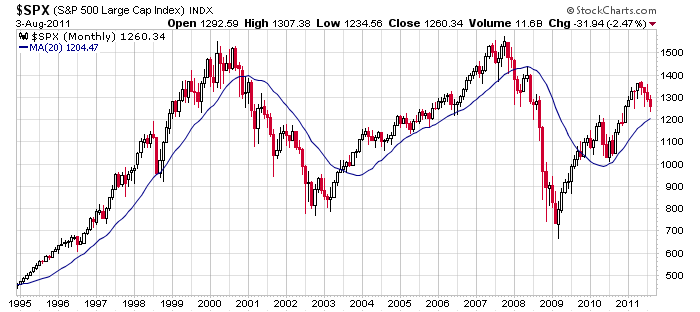

Yesterday the market finally bounced. It sold off hard early…lots of stops were hit, lots of sell programs were triggered, lots of margin calls no doubt added to the selling pressure. Then the indexes bottomed and bounced and closed green after having been down a bunch early. Volume was heavy and considering the losing streak and where many indicators were, the reversal was not a surprise. But as I stated yesterday, who knows how long this will last or how far it will go. Lots of technical damage has been done…enough that if left alone, the market will not be able to move up here uninterrupted.

My downside SPX target remains 1200 (or thereabouts). Several days ago that target constituted a decent drop, but yesterday’s low was 1234 and today’s open will be around 1245 – we aren’t that far away. That’s the line I’ll be using to determine the long term trend. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 4)”

Leave a Reply

You must be logged in to post a comment.

Checking some of the blogs that I follow, they all point to the

next wave down: 1) $SPX 1234.56 2)then bounce into yesterday’s

high of $SPX 1260 and; 3) down to the S&P 1200 area. HW

i would not be to gleefull about a strong move up from here or a strong bounce

there is more downside

this is a usa,europe,japan crissis,thats hurting asia

a crew cut is the recomended hair style and the instos know it

AussieJS: I would like to take you & Zen to New Orleans and show you

the power of the mighty Mississipi River. So the point is do not

underestimate the mighty power of the Dow Jones Industrial Avg. HW

(buy programs might kick in sometime today, an hour into trading)

the danube river is nice atm and is flowing downhill,with rapids ahead

Without the stimulus, what reason does the equity market have to go up? I don’t think 1000, this time next year, is unreasonable.

That’s what Maggie told me last night, Neal. We have to wait

before we get back together again. HW (in 100% cash at the moment)

You and everybody else (except Neal) is going to cash. The ESU1 (5 min for today) looks like a frigg’n dive bomber.

Lots of short cake.

short what the instos hold as its a insto sell off

they have to raise capital to pay for their haircuts

the selling is coming from europe –they hold usa shares

watch the dax for a turn

forget the charts –no bounce till liquidations over

also dax at 6400 is the target for the h/s extension down

and that has just been hit

so maybe that will effect the liquidations

target for ftse is now 5000

usa bounce to main piviot pos after europe closes at high noon

Down 2.96%! Like shot’n fish in a barrel.

at the appropriate time many times a day

the rut has broken its year long sideways

the dji is a square or cube but definitly not a triangle

and the spx has been eaten by the jaws of death

Enough carnage!

That last dip (ESU1 2min 11:46 ETZ) looks like it was bought, but I’m going wait for the ‘All Clear’ from Neal before I go LONG.

it was a tick negative extreme at piviot suport

so some bounce pos

Neal is making apple stew

Not sure Neal should have access to knives right now. LOL

Volume’s dropping. Time to SHORT.

Low volume on the dip, but this is afternoon, flip a coin. Currently forming a pennant which should resolve to downside.

Anybody got a good Hush Puppy receipt? I’ve got a lot of fish to fry.

if we knew the contrived jobs nos tomorrow,but im sure the instos do

so i would be flat at end trade today

by the way the instos have been setting up for this down for 2 months and are well hedged short all the way down and pos for another 2 years

target spx 333

333?

alright spx 111

but if we close on our lows today that could be the capitulation at Jasons 1200

$SPX 1200 looks like it’s trying to hold. Tomorrow will be litmus US.

there are no bids out there

if the apples get worms and the defensives in the ndx 100 give way—-well

1175 on spx–but we are at support and panic capitulation pos but doesnt have to be

who knows –its been a great nite and am going to sleep