Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets got crushed. Every market dropped, most lost more than 3%. Europe is down across-the-board. Losses aren’t as bad as Asia, but they’re still pretty stiff. Futures here in the States point towards a flat open, but I’m writing this prior to the employment numbers.

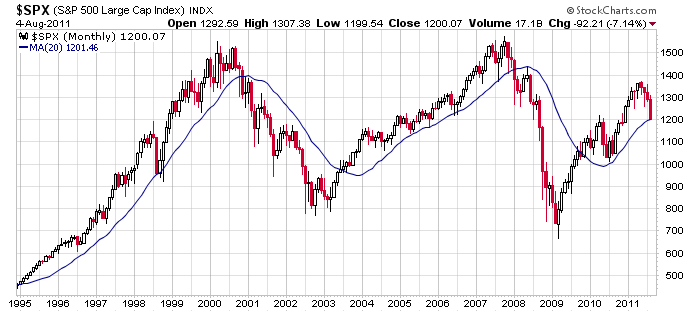

When I stated my SPX target was 1200, I figured it would take a couple weeks to get there. No way did I think we’d be there in one week. Here’s the chart…

I looked at many charts last night. They are more destroyed than I can ever remember – even during the financial crisis. So many stocks have not just broken down, but have free-falled. Some stocks (with no news) have literally lost two years worth of gains in two weeks. Obviously the market is not healthy. It’s due for a bounce, but a bounce will get sold into. Absent the Fed stepping in, the market has no chance of just bottoming and moving up. Sure it’ll bounce, but there are too many bag holders wishing they would have sold at the beginning of last week.

Here are the employment numbers:

unemployment rate: 9.1% (from 9.2%)

nonfarm payrolls: up 117K (vs. 84K estimated)

private payrolls: 154K

average workweek: will post when I see the number

hourly earnings: up 10 cents, or 0.4%

The market’s reaction was straight up. Let the good times roll. I think 120K jobs is needed just to keep up with population growth…and of course lots more to bring the unemployment rate down. So things aren’t really better, they’re less bad, and that’s a reason to be optimistic? S&P futures went from being up a point to up 20 and now are up about 11. I expect today to be a busy day. I’ll have more to say after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

yesterday’s sector performance

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 5)”

Leave a Reply

You must be logged in to post a comment.

why are insiders selling corporate bonds

Because they’re buying gold so they can pawn the gold to float their payroll. Just a guess.

If you are a day trader like me, one thing I like to do is

keep a DIA call option in buy status with no real intenton

of buying it at the moment. But what it does folks, it

monitors the amount of bids vs. the asks, and if anything

at all it gives you a short term signal as to who is

buying and who is selling at the moment. Just keep on

hitting the refresh button every so often and you’ll

see what it is I am talking about. HW

the ndx 100 had to hold and its not–atm

still insto selling and negative tick extremes

may get better after europe closes

I think this is a short cover. I don’t see a rally. 1151 here we come.

I was wrong.

RichE: You sound like an honorable businessman. I wish I could

take out a loan from you at 1% interest. 2) Daily charts are

still pushing down hard, so in my opinion we need a few more

days of zig zag (consolidation) until we make our next move.

3) Notice how Jason never comments on his own blog during

the day unless he is forced to do so by some person calling

out his name in vein and must respond to the venemous

outcry of lies, lies and more lies! HW

Why should Jason defend the Sunrise? Jason is just stating his observations, the sun came up, the sun went down. Why should he need to defend that? Clarify, if needed, but not defend.

Why would you put anyone on the defensive? What’s the point? It only builds walls.

A 1% loan? Are you going to start a soup kitchen?

ESU1:

High 5/2/2011 1367.5 1367.5

Low 8/5/2011 1183 1183

15.60% 13.49%

However you want to spin it, it is double digits.

if the markets cant rally into the close on good news then its not ment to just yet

the instos–hedgies have been seting this up for over 2 months

i have been watching them world wide take price to a opt strike and hold it there till filled

they are after the mutuals/long only pension funds and Neals money

and price has to go lower before mutuals liquidate

im going to have a midday nap now

It’s Friday, it’s August I don’t see a rally until the politicians come back from their break. Oh! I forgot, the gov’ment doesn’t affect price. Duh!

the bulls were weak

i was arrogant enough to sleep as the bulls charged

a day of consolidation and meditataion for the markets

could go either way

s/term trend down

will china own europe or will germany

Germany and China rule the world. That’s scary.

will usa bail out europe

Yep, it’s easy to be arrogant when you make a killing. See ya Monday.