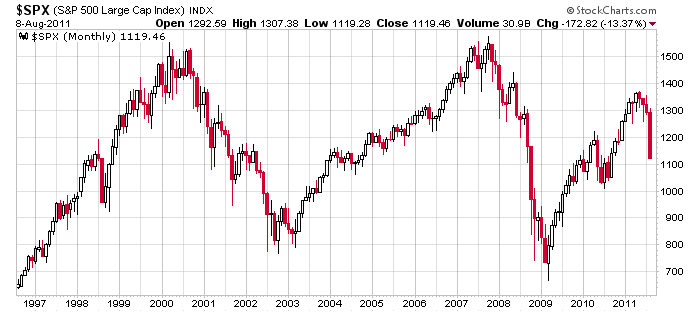

Here’s the S&P 500 chart going back 15 years. We had a big rally during the late 90’s…a big sell-off from 2000-2002…a big rally from 2003-2007…a big sell-off from 2007-2009…a big rally from 2009 to 2011…and now we’re in the beginning stages of a big sell-off.

Will this time be different? Comparing the current situation to the previous two tops suggests this time could be worse. Here’s why:

The 2000-2002 Bear Market: When the market topped in 2000, the general mood in the country was great, the economy was doing great and prosperity was everywhere. Unemployment was low and housing was, well it was housing – boring and a reliable storage place for wealth. The stock market was very high, and the Fed Funds rate was at 6.5% (after Greenspan raised it in the summer of 2000). If the market was going to come down hard, the circumstances could not have been better.

The people most effected by the tech bubble bursting were the ones best able to bounce back – smart, educated, 25-year olds. Some got jobs with other companies; others started their own companies; and others went back to school to get their MBAs or other advanced degrees. The group most effected had the brains, initiative, talents and ability to take a deep breath and start over. The Fed also had all the tools in the tool box to use to prevent a total market collapse. The Fed Funds rate was lowered to 1.0%. Pain was felt, but other than stock market losses, it wasn’t hard for America to bounce back (even though it took a couple years).

The 2007-2009 Bear Market: When the market topped in 2007, the general mood was pretty good, the economy was doing well, and prosperity was present but not as prevalent as in 2000 (how could it be, the internet enabled the largest expansion of wealth in history). Unemployment was low, and although housing had already topped, it hadn’t come down too much (other than a couple places where it ran out of control) and foreclosures and steep losses were not headline stories yet. The stock market was at all-time highs (not the Nas which was artificially inflated by companies that don’t exist any more), and the Fed Funds rate was at 5.25%. So again, if the market was going to come down, the conditions were pretty good. On the flip side, making matters worse (than 2000), two very expensive wars lingered, and our national debt was becoming a joke.

The banking crisis that followed had the potential to cripple the worldwide economy (unlike the tech bubble bursting), but again America had a cushion and the Fed had access to an assortment of tools to dampen the intense selling pressure (Fed Funds rate lowered to basically 0.0%, banks and insurance companies got bailed out). The country was in a position to avoid a total collapse (whether you agree or disagree with the tactics used).

The 2011-20?? Bear Market: We are nowhere near as well positioned to deal with a bear market. The general mood is very negative. Republican or Democrat – doesn’t matter – people are sick and tired of Washington. If you use the market averages to hint at the economy’s strength, you’d be tricked into thinking things are going well. They aren’t. The averages are controlled by the large, multi-national corporations which can easily tap cheap labor markets overseas and benefit from a favorable exchange rate. The reality is corporations are not growing organically, and the economy hasn’t improved much since the financial crisis ended. Unemployment has been above 9% for 2-1/2 years, and housing is in the dumps and could take two decades to recover. The Fed Funds rate is already at 0.0%. The financial system was bailed out, and even though banks have recorded recorded profits, they’re still sitting on hundreds of billions in losses (thanks partially to suspending market-to-market accounting), and are not much better off today than two years ago. QE1 and QE2 helped prop the market up, but the benefit hasn’t been felt by average Joe American. Other than the market being near its highs, the circumstances for a bear market couldn’t be worse.

In a nut shell, with unemployment high, housing in the dumps, failed bailouts in recent memory, failure Fed stimulus, an already-low Fed Funds rate, what can be done to stimulate the economy or dampen a market collapse? Suspend short selling? That’ll cause a 1-week rally. Then what.

Bottom line…we are not positioned to deal with the stock market getting cut in half.

Jason Leavitt

0 thoughts on “This Time Could Be Much Worse”

Leave a Reply

You must be logged in to post a comment.

Hi Jason, I know you’ve been avoiding the principles of Elliott Wave theory and down on guys like McHugh. But now maybe after all this time they do have a point. Will the market go straight down to the March 2009 lows? Not right away, but I’m sure people like me and you are already thinking along those lines. The President’s speech today did absolutely nothing and he appeared like a whining fool. In fact, there probably is dissention among the ranks now because the inability or the unwillingness for the Fed PPT Pomo not to step in and allow these markets to go down over 1000 points in two trading sessions is astounding to say the least. By the way today, August 8th is one of those Elliott Wave phi mate turn cycle dates, so we’ll see what happens. HW

Howard—-it has nothing to do with 3/09—-we are going to zero

3/09 is the target for this current wave–yes we may have wave 4 but then wave 5 will hit

people dont realise how bad things really are ,after all the lies they have been told worldwide by pollies,banks and central banks

Aussie: I am defecting from the USA and I want to become an Aussie national.

Will you sponsor me down under? HW

yes–u need to get out of usa-europe and japan—-all are cactus

Just some thoughts

– We may be witnessing a selling climax

– Intervention by China

– Margin requirements for shorting

– High frequency trading limitations

I seldom disagree with Jason. This feels like 1987. (did I tell you I made a lot going long in 87?) The markets are still above last Summer’s lows. P/E’s are still low. The economy may be in the tank but it is a little better than the doom and gloom. This is MOABO for the long term investor. I am not here to tell you the market won’t go lower. The market will bounce and perhaps go back to test the lows where ever they may be.

I will say if we get a gap down look for a nice technical bounce for a few days. Then during the coming retest look for MOABO!

the 87 crah caught me –i was long everything commodities

and so arrogant that i was sailing down the nile in a fuluka ,with a all girl crew

unaware i had been sold out

the little 2 day bounce is happening in the xjo —oz markets after a big down

aussie leads the world

i know what the fed knows–bernickie is a failure,because he cant control the world or even usa pollies

china wont buy berger king it will steal it

tornados for tues

steve jobs only makes money on a week usd

apples are bad for ur health ,but apple cida vinigar is ok

no Neal — i am rich manipulator

investors die hedgies win

we had the 2008 crash ,then we has the liars counter trend wave 2 –now wave 3 has to go below mar 009

did u short the bin ladin may 2 top—i did at 12900 dji cash premarket spot on

i will buy at 6000 for wave 4 up

all that said —im in carefull mode

got gold?

Enough gloom guys, lets hear some bright ideas how to fix it. I’m sure the smartest investors are those who are buying. Oh well, its not me, I’m fully invested for a retired 77 year old.

If a company pays me to hold it’s stock, then it might be a conversation worth having. Dividends are one of the few things that make sense to me in this market. With someone turning 60 every 8 seconds, surely stocks that pay you to hold will be a possible bright spot in the decade ahead. Why would I own 3 shares of Microsoft when I could own 1 share of Caterpillar?

solution, we need more I phones , and I stuff from Apple.