Good morning. Happy Friday.

The stress tests were officially released yesterday after the close. The futures market has reacted favorably to them. Just prior to the 8:30 am release of the unemployment report, the S&P futures were up about 12.5, matching yesterday’s loss.

The Nas is currently on an 8-week winning streak. It’ll have to move up 3 points today to continue the streak. The S&P is on a 7 of 8 winning streak which will turn into 8 of 9 baring a total bloodbath today.

Overall it’s been a good week. Strength Monday and Wednesday…some selling pressure yesterday. The higher highs and higher lows continue; the intermediate term up trend continues. The Russell is almost 50% off its Mar low; the S&P is almost 40%. In the grand scheme of things, I consider this a bear market rally, but as I’ve stated numerous times – and as has been obvious by the great number of stocks on the LB long list and the empty short list – I’m not going to try and guess a top. If the market wants to go up, by all means, let it go. If you’re bullish (I have been and am in the intermediate term), ride it for everything it’s worth. If you’re bearish, be patient. You should be thrilled at the prospects of shorting at a higher level.

The unemployment report has caused some selling in the futures market, but the futures market still indicates a large gap up today. This of course could change by the opening bell.

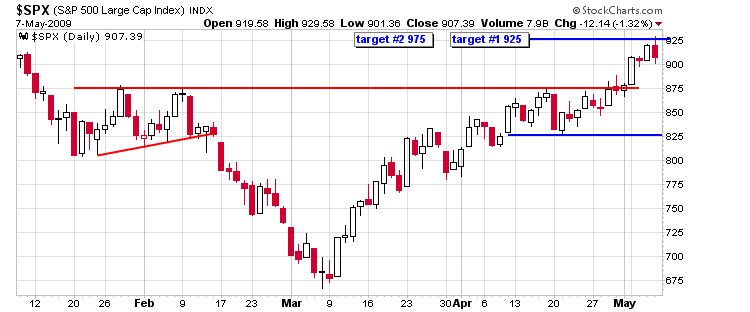

Here’s the daily SPX. My first target (925) has been hit.

It’s been a great week…lots of solid breakouts. Lighten up before the weekend.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades from breifing.com

earnings & economic releases from LeavittBrothers.com