Good morning. Happy Thursday.

The market is in idiot mode. That’s when the market gets bought up despite prior gains and all logic and when you’re literally amazed at the bulls’ ability to keep pushing prices higher. I’m one of those bulls (for now). When many others tried picking a top (several times) I stuck my chart analysis and simply said: “there’s nothing in the charts that would suggest a huge sell-off was imminent.” I know the gains don’t make sense. I know half the banks would go bankrupt if not for hundreds of billions the government dumped in them. I know the unemployment rate continues to rise and the housing situation isn’t getting better. I know we’re in the midst of the worst financial crisis since the Great Depression. I’m aware of all the reasons why the market could have bounced off the lows but not rally off the lows. But despite all that is bad, the Russell 2000 is up more than 50% off its low and the SPX 40%. For those of you who doubt technical analysis, I can’t think of a better persuasive argument. If you trade/invest off the fundamentals, you would have never been long off the March low and you certainly wouldn’t have gone long in the past week as literally dozens of stocks broke out and rallied. But technical analysts don’t study what should happen, we study and trade off what is happening. We covered our shorts within one day of the March low and went long one day after and have basically stay long or maintained our long bias ever since. We were able to do this for one reason and one reason only. It’s because the charts told us to maintain a long bias. Simple as that. The trend was up and there were no warning signs offered. Keep it simple.

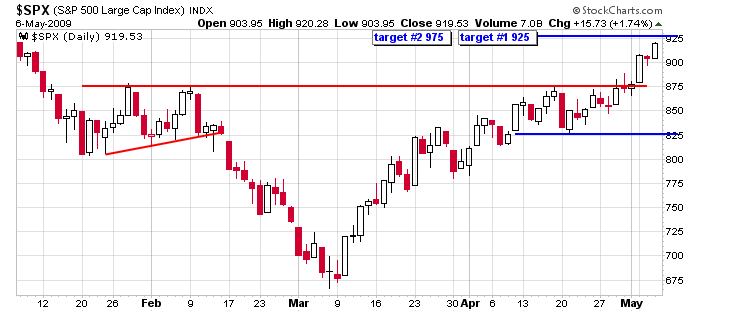

Here’s my daily SPX. The first target will get hit at today’s open because the futures point towards a decent gap up. But we must be aware of a possible ‘buy the rumor, sell the news’ scenario. The market – especially the financials – have run up big into today’s official release of the stress test results which have been leaked little by little over the last week. If we don’t get a sell-off today, look for some profit taking tomorrow after the jobs report comes out. In any case, the trend is up; we’ve had numerous great breakouts, but don’t get lazy. Be a trader, not a buy and holder.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases