Good morning. Happy Wednesday.

After a big up day Monday, the market took the day off yesterday. No big deal in the grand scheme of things. The ‘2 steps forward, 1 step back’ action continues.

Bank of America (BAC) has been warned it will need to raise $35 billion – much more than many expected. I stated yesterday if the stress tests revealed several banks needed to raise a couple billion, the market would react favorably, but $35 billion is a little more than “a couple.” The futures market reacted negatively to the news and stayed negative all night, but more news out this morning has caused the futures to spike higher. Hence we’re looking at an up open (for now).

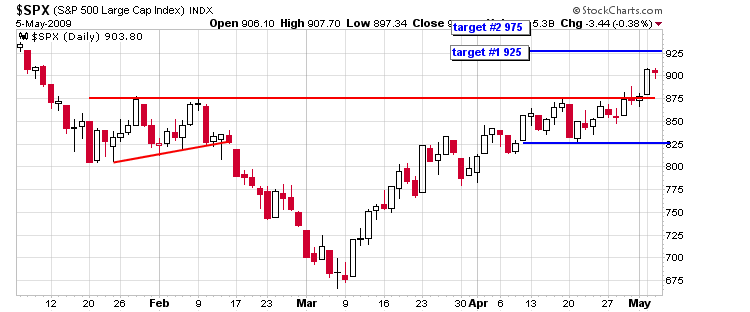

Here’s my SPX daily. I’m sticking with my targets (925 & 975).

I’ve read lots of negative stuff lately…how rising unemployment will cause more foreclosures and the massive labor pool will cap wages for several years and the increased savings rate will dampen any type of economic growth and how it could take an entire generation for this banking mess to fully work itself out, etc etc, but the market keeps going up and up (yeah I know that’s a run on sentence). Heck, the Russell 2000 is up almost 50% since its March low. It makes no sense, but who am I to argue. If the market wants to move up, I’m not going to stand in its way. That’s why I’m sticking with long trades, and I’m not going to attempt picking a top.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

earnings & economic releases