Good morning. Happy Tuesday.

The market shifted into idiot mode yesterday. That’s where everything gets bought up irrelevant of all factors. Even the bottom of the barrel crap that has no business staying in business during a recession got bought up. Coal stocks and steel stocks (both highlighted over the weekend) did great. Oil did great (also mentioned). Perhaps my ‘inflection point’ concept will play out – a couple days after SPX 875 was penetrated.

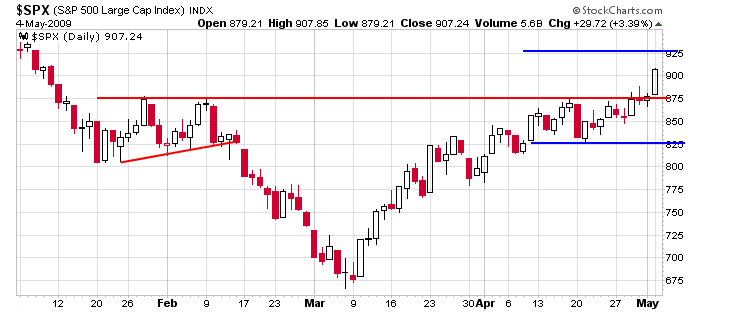

Here’s the daily SPX – nice separation from the breakout area. The depth of the pattern (from 825 to 875) measures up to 925, so that’s our target for now. But measured moves and targets won’t matter much if the market stays in idiot mode. It’s pure emotion. There’s been a growing bearishness over the last week or two, and as long as the bears try to pick a top, the market will continue to surge higher.

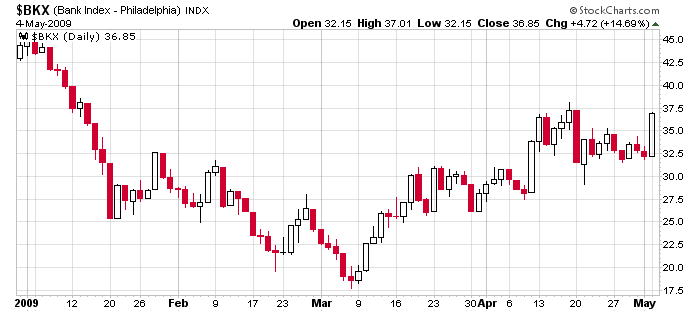

It was stated over the weekend that the banks must keep up. The market was making new highs, but the banks were lagging. Whatever the reason – perhaps some trepidation ahead of the stress test results – the banks had to improve. Here’s the BKX. Nice day yesterday. It’s got to continue.

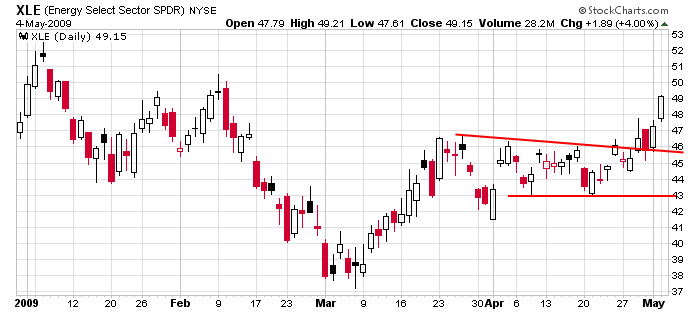

I also stated energy must do well because 1) It’s 13% of the SPX and 2) The implication is when energy moves up, demand is increasing because the economy is improving. Whether the economy is indeed improving is not something I know, but yesterday’s energy breakout was encouraging.

The trend is up until it’s not. Simple as that. The situation hasn’t changed since soon after the early-March bottom. There are only two positions right now – long and cash. Trying to pick a top is not wise considering there’s no evidence whatsoever a top is imminent.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases