Good morning. Happy Monday. Hope you had a nice weekend.

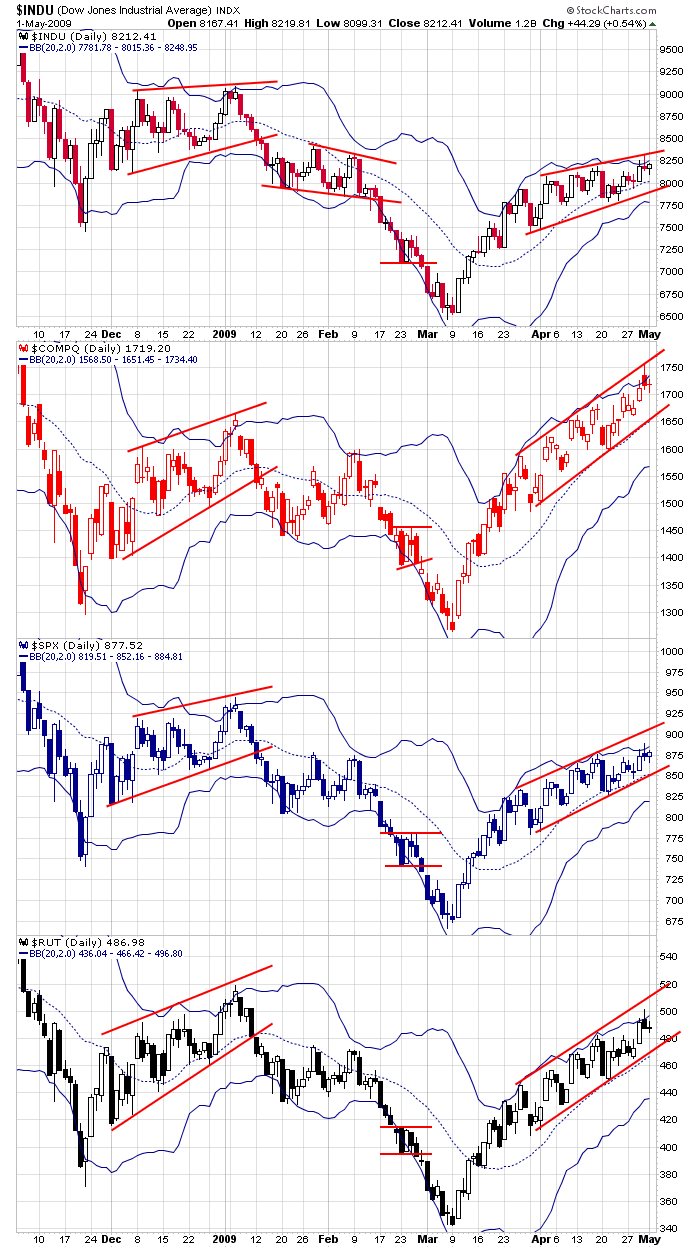

Last week was the 8th consecutive up week for the Nas and 7th of 8 for the SPX. Other than the first couple days off the March low, it’s been steady, methodical buying – 2 days up, 1 day down type of action.

I’ve been watching SPX 875 has a possible inflection point – a level that would bring late-to-the-party bulls to the market and cause shorts to cover. Such action would surge the market higher. Or that level would produce a false break – a pop and drop if you will. But so far neither scenario seems to be playing out. The SXP traded above 875 Wed, Thurs and Fri last week, but there was no sign the market was poised to surge higher or poised for a stiff decline. So instead of 875 being an important level, as of now, it’s been meaningless. Higher highs and higher lows persist – the rising channel continues.

Here are the daily charts. All are steadily moving up. All are near their upper Bollinger Bands. None are offering evidence a price surge or sell-off is imminent. The internal breadth indicators (not shown here) area at elevated levels, and a warning does come from the great number of small cap stocks/cheap stocks/crap stocks that are moving up.

Commodity stocks are doing well. Coal and steel did great last week. Oil looks poised to bust out and rally this week.

The best 6-month stretch of the year (Nov – Apr) is over, so the adage “sell in May and go away” now applies, but May isn’t a bad month; it’s an average month. The real weakness begins in June.

That’s it for now. No fireworks happened at SPX 875, so I feel like a broken record. The trend is up until it’s not.

headlines at Yahoo Finance

stocks to watch MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases