Good morning. Happy Monday. Hope you had a nice weekend.

So the market has gone from idiot mode to just not making any sense. It keeps going up and up and up. Every little dip gets bought. The Nas has now moved up 9 consecutive weeks, and the Dow, S&P and Russell 8 of 9. The market is embracing good news and ignoring bad news – this is typical of a strong market. How long this lasts is not something I know. I do know the trend is up, and I’m not going to attempt picking a top. There are many bears out there losing lots of money trading what they think should happen rather than what is happening.

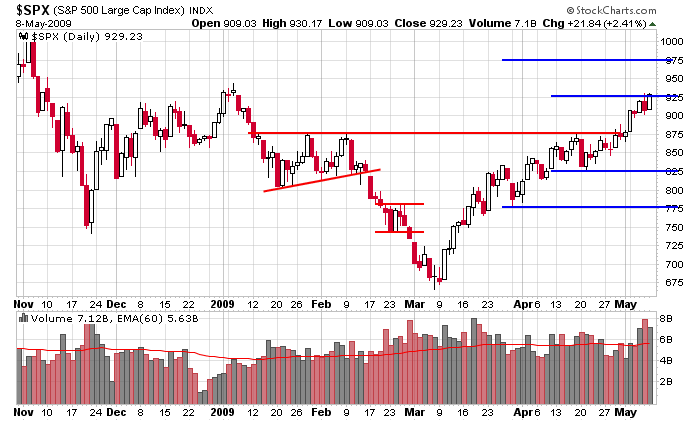

Per the daily SPX chart, our first target (925) was hit last week. Our second target is 975.

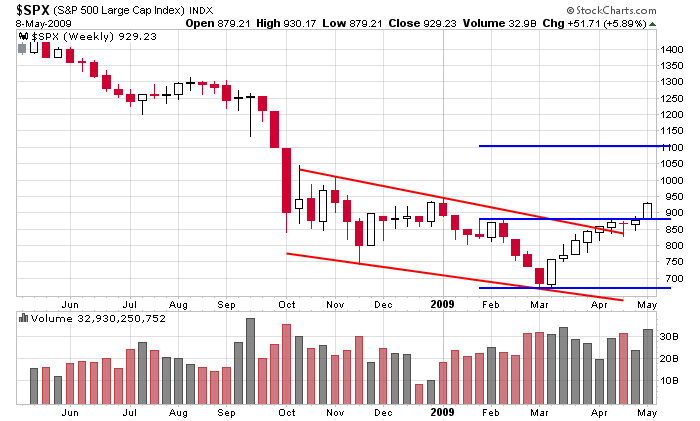

Per the weekly chart, our target is 1100. I’m not predicting it’ll get there. I’m just recognizing the possibility if the measured move off the low plays out.

Futures are down a bunch right now; most of Friday’s gains will be wiped out at the open. The banking group practically went vertical last week and is due for a rest. The semis were weak last Thursday and Friday. If the banks correct and the semis continue to drop, the market’s upside will be capped.

The trend is up, so my bias remains on the long side. But this isn’t a great big bull market. That means I’m erring on the side of taking profits too soon rather than letting the charts fully play out.

headlines at Yahoo Finance

stocks to watch MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases