Good morning. Happy Tuesday.

Over the last 16 days, the market has moved up 8 days and moved down 8 days. The longest winning streak has been two; the longest losing streak has been 2. Since the up days have been bigger than the down, the SPX net change over this time has been +40 points. Individual groups have taken turns tacking on big gains, but the indexes have been grinding. It’s a little frustrating to not get any follow through because it seems we have to seat on the edge of our seat every day. Every dip gets bought, but every other day we have to wonder if this will remain the case.

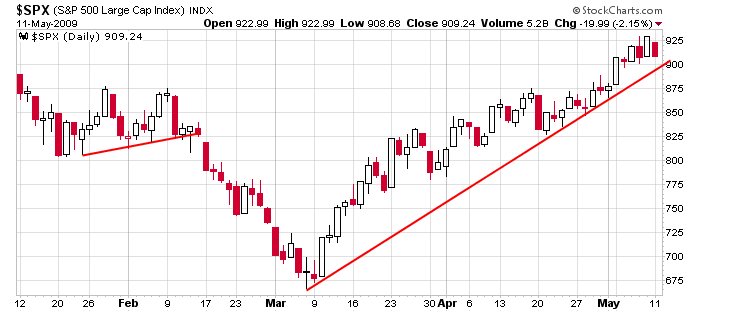

Here’s the daily SPX. A break of support doesn’t mean the uptrend will immediately end and the low retested soon after. The market could easily move sideways in a range before making its next move. Right now, I see no reason to guess when a top will be put in place. The bears keep trying, and that’s one reason the market keeps making new highs.

The semis were weak last Thursday and Friday. The banks needed a break after practically going vertical last week. Heading into yesterday, oil had been up 7 of 8 days. Hints were given the market needed a break, but the trend remains in place. My bias remains on the long side, but I’m not exactly relaxed.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases