Good morning. Happy Wednesday.

As stated yesterday, I’m officially neutral the market. That doesn’t mean I think the uptrend is over; it just means the market may need to rest and I’m not going to be aggressively long. Semis have been weak; banks need to pullback. Breakouts are not following through. The steady move off the lows has lasted two months. Maybe a top is in place; maybe the market just needs to consolidate before legging up again. I don’t know the answer, and I’d prefer finding out while I have less or no exposure.

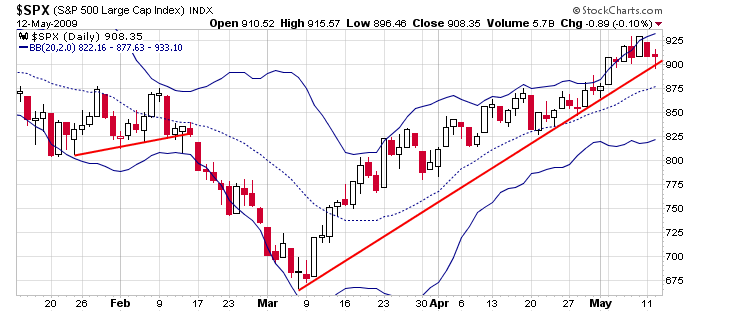

Here’s the daily SPX. A breakout of support won’t necessarily spell an end to the rally. It could lead to consolidation; it could just mean the market will move up at a shallower slope. In either case, I’m looking for a pullback to the middle of the Bollinger Bands near 875, and if that level doesn’t hold, the bottom band becomes my target.

There’s a time to be aggressive, and there’s a time to go fishing (as Jesse Livermore would say). I’m not going fishing, but with the market’s inability to get much traction this week, my style says lay low and let the market figure out what it wants to do next.

Futures are down a bunch before the open. It should be another volatile day.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

yesterday’s leaders & laggards

earnings & economic releases