Good morning. Happy Thursday.

For the first time in over two months the S&P has fallen more than two consecutive days, and over the last 22 days, there have been 11 up days and 11 down days.

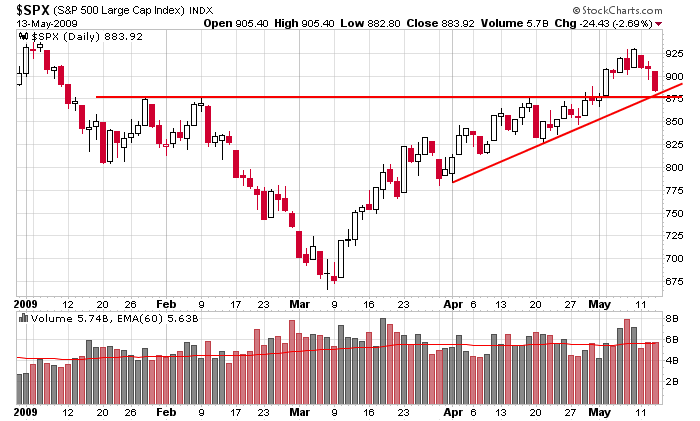

SPX 875 was resistance on the way up…now we’ll find out if it’s support on the way down. We also have an up-sloping trendline connecting the lows from the last six weeks intersecting around 875 too.

I think it’s wrong to assume the uptrend is definitely over. Since the March low, the Russell rallied 50% and the Dow, SPX and Nasdaq rallied 40%. We’ve had dozens of breakouts that went better than 20% and many that went 50% or doubled. If fact we’ve had so many breakouts, we had to start a ‘spillover’ list to keep track of them.

It’s possible a top is in, but it’s also possible the market just needs a rest. In either case, I watch these situations from the sidelines while keeping new trades short term (usually of the day trading variety).

If the S&P slices through 875, my target is 825. If 875 holds, we’ll have to see if the bulls have any giddy-up in them. Before assume the lows will be tested in the next couple months, remember the role the government is playing. Things that don’t makes sense are happening. The banks were manipulated up solely to give them an opportunity to do secondary offerings at higher levels to shore up their books. The normal forces of supply and demand are not at work here.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases