Good morning. Happy Friday. Happy Options Expiration Day.

Barring a gigantic rally today, the 9-week winning streak for the Nas and Russell will come to an end. It’s about time. The consistency of the move is not something I’ve seen in a long time. Every little dip got bought…every time the bulls got a little scare the indexes made new highs a day or two later. The party may be over for now, but that doesn’t mean a top is in and a resumption of the bear market about to begin. It just means the indexes may need to rest.

But every sell-off begins will simple profit taking. A top could be in place or the market may just need to rest. I don’t know, and when I don’t know, I trade much less aggressively (if at all) with smaller position sizes. I make the bulk of my money within the trends, not during turning points.

Here’s the SPX daily. The trendline drawn off the low (red) has been penetrated and may now become resistance if the market bounces (910 area). The trendline using more recent data (blue), which in my opinion is more relevant, has not been penetrated and coincidentally happens to intersect at around 875 – resistance on the way up.

If the SPX can hold 875 and bounce, the forcefulness of the bounce and whether volume and a new batch of 52-week highs are registered will go a long way towards suggesting the next couple weeks.

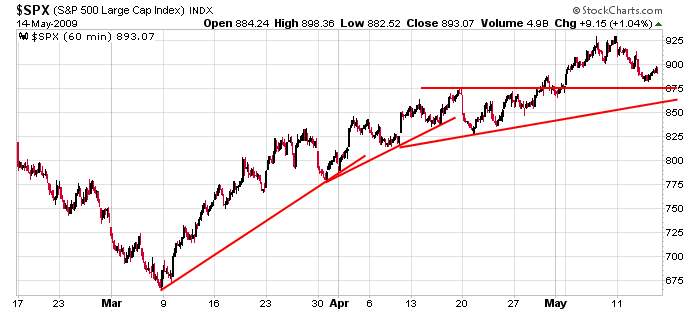

Here’s the 60-min chart. It doesn’t look too bad. Higher highs and higher lows remain in place.

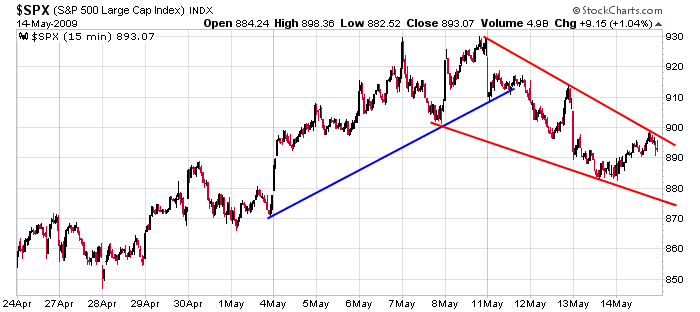

And here’s the 15-min chart. Several times during this 11-week rally we’ve gotten a falling wedge against the overall uptrend.

It’s Friday; I’m not taking any big chances. As stated earlier, I make my money within the trends when trading is easy, stocks follow through and stress levels are low. I leave the turns for others.

headlines from Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades & downgrades from briefing.com

yesterday’s leaders & laggards from LeavittBrothers.com

this week’s earnings & economic releases from LeavittBrothers.com