Good morning. Happy Tuesday.

Coming off its first across-the-board down week in over two months, the market gapped up and rallied all day yesterday. Steady buying all day characterized by every little dip getting bought was reminiscent of many days over the last eleven weeks. Internals were strong, and about 95% of the market groups closed up. The only warning came from the lack of conviction – volume was lightest it’s been in well over a month. And of course we now have another unfilled gap below.

Last week, while many market participants turned bearish, I merely turned neutral. It’s possible a top is in place and the lows will be revisited this summer, but it’s at least equally possible the market needed to take some time off. After all, the indexes had just rallied 40-50% in just over 2 months. And something else I’ve been trying to drill into everyone. This is not a normal market. The government is playing a very active role. What should happen won’t necessarily happen – at least not when you expect it. Don’t rule out illogical and nonsensical moves.

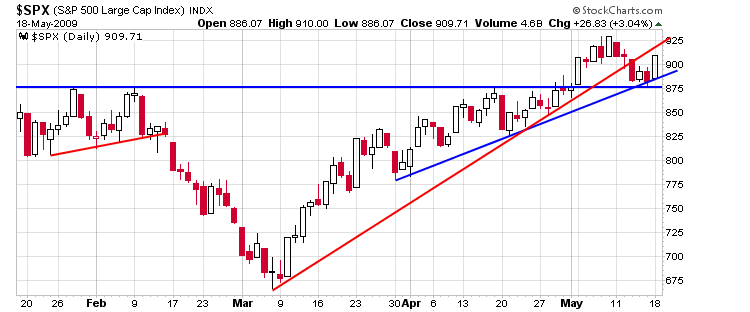

Here’s the SPX daily. Support from the last two lows within the uptrend held and 875, which was stiff resistance on the way up and is now support on the way down, held.

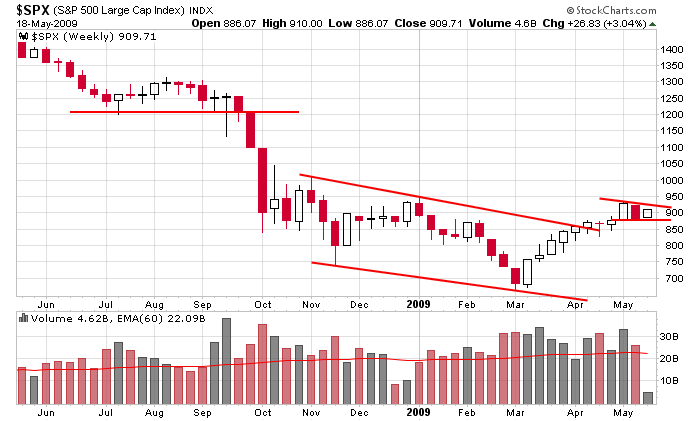

And there’s the SPX weekly. There’s nothing wrong with a couple weeks of consolidation within an intermediate term uptrend.

I remain neutral. No bias here.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases