Good morning. Happy Wednesday.

The market didn’t do a whole lot yesterday. Early strength was matched by late weakness, and in the end, the indexes closes mostly down but no index lost more than 0.4%. That’s not horrible coming off Monday’s big move. Futures are up this morning.

Overall I continue to see nothing horribly wrong with the current action. Higher highs and higher lows remain in place. Some indicators are in overbought territory (they can stay overbought for a long time) while others are showing small signs of weakness. The charts themselves look constructive. A couple weeks of consolidation would not destroy the generally positive sentiment.

It’s at times like these (equal number of up and down days going back many weeks) that I remind myself it only takes one or two good trades each week to make a living trading. You don’t have to trade every day, and you certainly don’t have to trade many times per day. If all you did was make 1 or 2 points with 1000 shares a couple times per week, you’d make six figures. Then when things are more clear, you could size up and trade more often. That’s all. One or two good trades is all it takes, so you can wait for the good set ups and pass on the so-so ones.

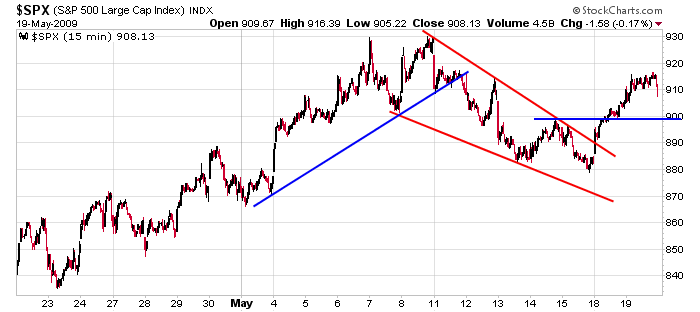

Here’s the SPX 15-min chart. A breakout from a falling wedge has left the index near the midpoint of its most recent range.

One or two good trades each week is all it takes, so pick your spots wisely.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

yesterday’s leaders & laggards

earnings & economic releases