Good morning. Happy Thursday.

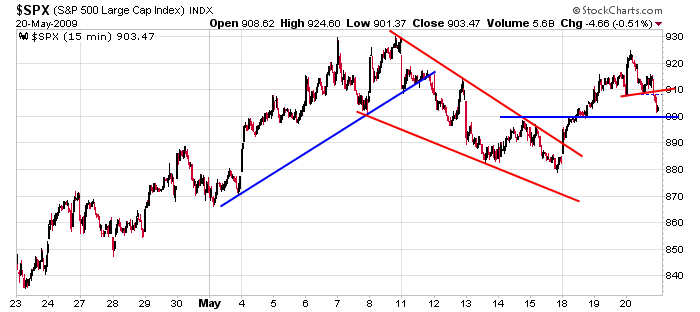

If strong markets tend to be weak early in the day and strong later, the market is showing more signs of weakness. Tuesday the market sold off into the close and yesterday the market got hit hard the last 90 minutes. Futures are currently down several points, and the S&P is set to open near 900 – the target I set yesterday on the Market Window. If 900 gets taken out, Monday’s gap in the low 880’s could be next.

Many ugly candles formed yesterday, so the bulls have their work cut out for themselves today and tomorrow. Dips continue to get bought, and I’d still consider the overall trend to be up…but a lower high was established yesterday – something the bulls will have to overcome.

The market is closed on Monday for Memorial Day.

A couple things continue to be on my mind. These are not normal market conditions. The normal forces of supply and demand are not at work. The government is always somewhat involved but never to this extent. What logically should happen won’t necessarily happen (at least not in a timely manner). Abnormal activity and movement that makes no sense is commonplace. Expect the unexpected…or at least don’t be surprised when it happens.

It’s times like these I remind myself to keep things simple and focus on making one or two good trades each week. When trading is easy (the trend is strong and you could blindly get in almost any stock in the direction of the trend and make money), I size up and trade aggressively. But when the coast is less clear, I focus on just making one or two good trades each week and otherwise waiting for the charts to reset. Now is one of those times.

Here’s the 15-min chart SPX chart. If 900 is taken out, I’ll key on Monday’s gap in the low 880’s.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases