Good morning. Happy Friday.

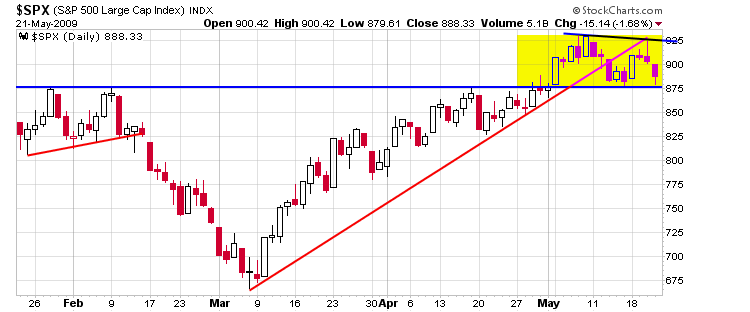

It’s been a heck of a week. Strength Monday and Tuesday turned into weakness Wednesday and Thursday. As of now the SPX is posting a 5-point gain for the week. Strong markets tend to be weak early in the day and strong late and weak early in the week and strong late. This obviously isn’t the current case. Nevertheless, the S&P has held support, so the consolidation continues.

From a trading perspective, we don’t have a strong wind at our backs, so our holding times have gotten cut as has our position sizes. Instead of playing a breakout and being able to sit back and let the market do the work for us, we’ve had to more actively manage our positions…meaning our holding times have been cut. Instead of getting in and making 20% in a week or two (we had dozens of these types of trades in Mar and Apr), we’ve had to be content with 5-10% moves that only lasted a day or two. We have to trade the market we’re dealt, so although we’d prefer holding longer, it is what it is. You adapt or you die.

Here’s the daily. A lower high is in place and support has held. Looks like consolidation to me.

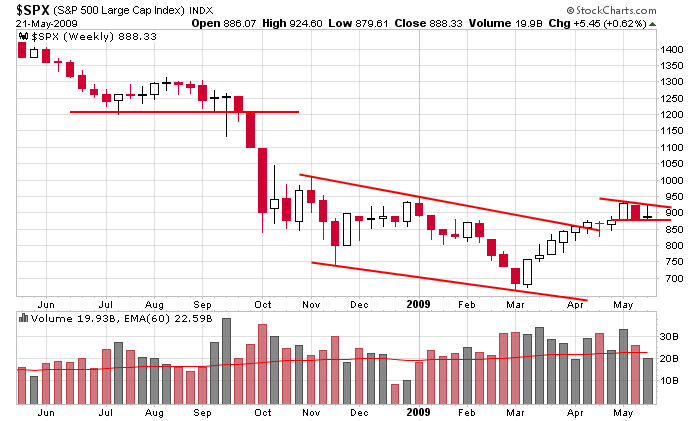

Here’s the weekly. A breakout could easily lead to a move above 1000 while a move down could see 800 quickly.

The market is closed Monday.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades from breifing.com

yesterday’s leaders & laggards

earnings & economic releases from LeavittBrothers.com