Good morning. Happy Tuesday. Hope you had a nice weekend.

It looks like we’ll begin the week with some slight weakness as indicated by the futures market being down a couple points, but this of course could change between the time this is posted and the opening bell.

Both the bulls and bears got something to be excited about last week but neither could get much follow through. The week started strong and ended weak – everything gained Mon, Tues and early Wed was lost late Wed, Thurs and Fri. The high and low of the week were contained within the high and low of the previous two weeks, so the consolidation continues and pressure builds.

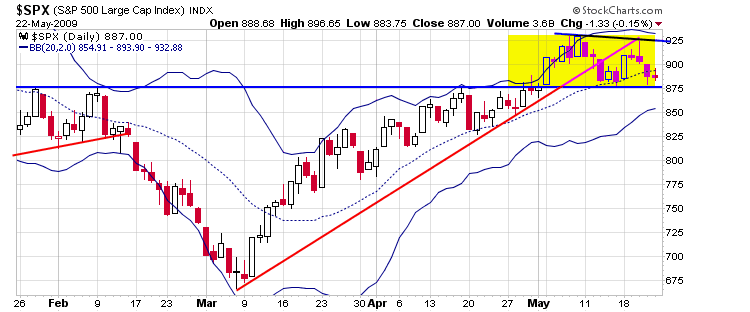

All the indexes have closed below the middle of their Bollinger Bands on the daily charts. In all cases, my targets are the lower bands. For the SPX, this constitutes a move to about 855. Here’s the chart.

Summer is officially here. Let’s consider a couple scenarios. 1) SPX support at 875 will be taken out but it’ll be a bear trap. After some selling pressure, the market will quickly rebound and eventually rally to a new swing high. 2) Support will hold, and after more consolidation, a new swing high will be registered. 3) Support will be penetrated and it’ll be obvious from whatever bounce occurs afterwards that lower highs and lower lows may be the norm for the summer. Whether the lows are tested quickly or in several months may not be apparent, but it won’t matter. Playing the downside would become our focus.

Right now I’m neutral with a slight bearish lean. Some internal breadth indicators I look at are breaking down.

Sometimes it’s easy to trade…sometimes it’s more challenging. Right now it’s a challenge, so I’m not being overly aggressive.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases