Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. Hong Kong, Singapore and South Korea each dropped more than 3%. Europe is currently down across the board. London, Stockholm, Germany, France and Belgium are currently down more than 3%. Futures here in the States point towards a moderate gap down for the cash market.

Gold and silver are down about 1%. Copper is down almost 3%. Oil is down about 2.6%. The dollar is up.

The market is still being held hostage to Europe and more specifically Greece. The assumption is Greece will default on its debt, but it’s not entirely known what ultimate effect this would have on Europe’s banking system. Germany’s debt insurance recently hit a record high.

Bernanke is testifying in Washington today about the current economic outlook and recent monetary policy actions.

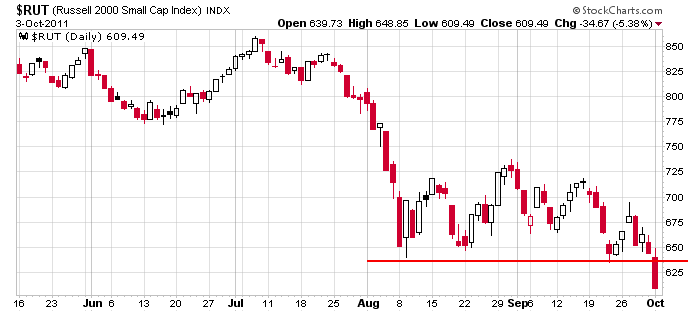

There isn’t anything for the bulls to be excited about, and we are far from a complete washout. The breadth indicators (AD line, AD volume, 52-week highs and lows, number of stocks trading above various moving averages and others) are trending down but not close to washout levels. The rock solid companies that have done great for a long time (AAPL, AMZN, BIDU, PCLN, WYNN and others) are cracking. Safe haven stocks (JNJ, PG, WMT and many utilities) have out-performed recently. The small caps have been lagging. Here’s the Russell…a clean break down.

Here’s the banking chart. Maybe buyers step in here at support, but otherwise we have a new closing low.

The trend is down. I’ve been saying that for two months. I hope you have not been in denial. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 4)”

Leave a Reply

You must be logged in to post a comment.

Good job sticking by your guns in your downtrend assessment, despite head fakes and other’s opposition.

it would not be uncommon to have a small bounce that takes out the stops before the wash out

have ur washing powder ready for the wash out

The gap opening on SPX around 1098-1100 could be filled but a layer of resistance between 1101-1114 should prevent further upside in the near term. 1000-1050 appears to be the downside target before a more significant rally may occur.

I’m gonna take a 1/3 of a full short position at SPX 1098 and go from there.

About now looks good to go short.

If SPX can hold 1085-1088, the rally can extend into the 1101-1114 area. I’m short 1/3 at 1098 & I’ll put on another 1/3 short position at 1106. If we fail to hold 1085, I’ll think about adding 1/3 into any resistance above 1090.

i sold for a exhuberant price,my 2 dead cats,-gruesome/awesome to uncle ben as he had nothing left.but they are old and defective and have arthrightis

SPX 1106 not being acheived on today’s intraday rally makes me think either that’s all for now OR, this pullback from the rally high holds at/above 1085 and we mount a continuation of the rally and test 1114 or higher. So, I’m cancelling a sell order at 1106 and I’ll watch to see if 1085 -1090 finds support.

if today turns out to be a bull then i will have a bull sandwich–they are tasty

—a one day up that cant go on with it ,is normal in bear markets

Well, SPX got down to 1080 before reversing but the outcome was what I had anticipated might happen. I’m shorting another 1/3 on the close and leaving the last 1/3 until I see tomorrow’s action.

with the dji back to 10800 could that be the end of wave 2 or a 4