Good morning. Happy Thursday.

I’ll repeat what I wrote yesterday after the close.

The market continues to generate lots of noise.

The bulls controlled Tuesday; the bears controlled Wednesday.

On Tuesday, the market recaptured 4 days of losses with one felled swoop; on Wednesday, those gains were almost entirely given back.

Bottom line is the market continues to consolidate and it continues to get virtually no follow through in either direction.

Whether you’re bullish or bearish doesn’t matter. If you’re not on the right side of the market today, just wait a day or two.

I’m still neutral. I’m still keeping trades shorter term. I’m still recognizing the normal forces of supply and demand are not at work because of the outsized role the government is playing and because of this, what logically should happen may not.

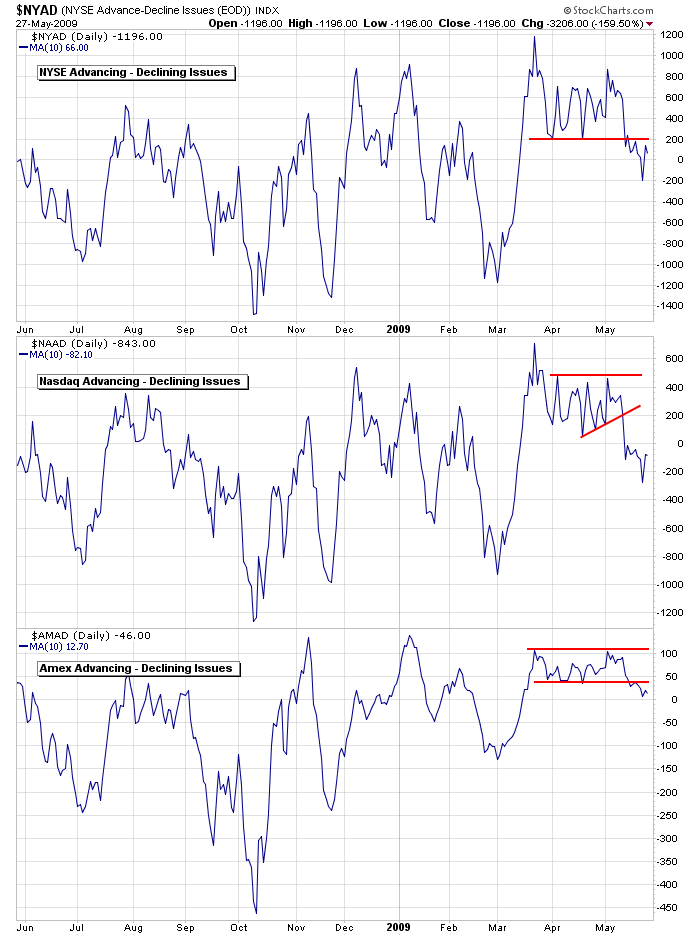

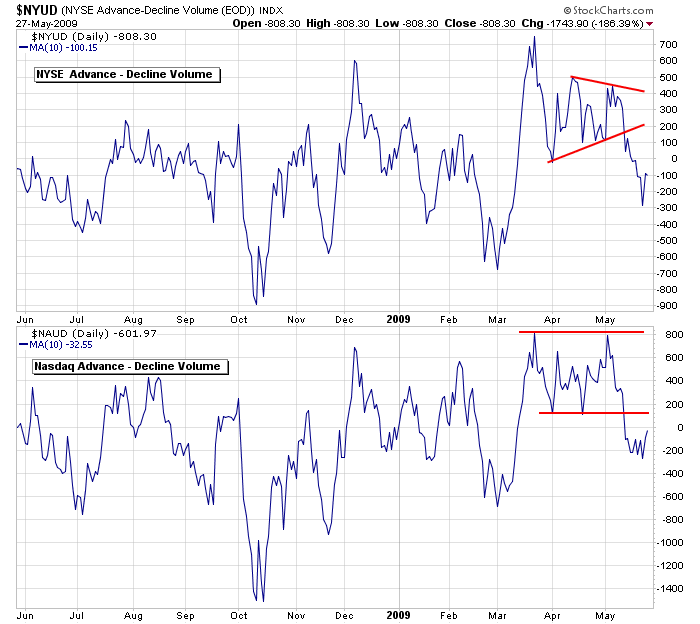

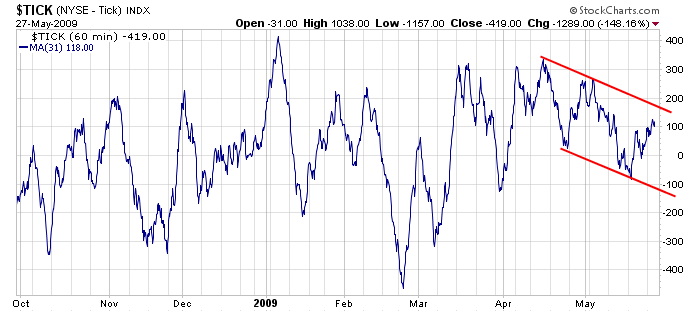

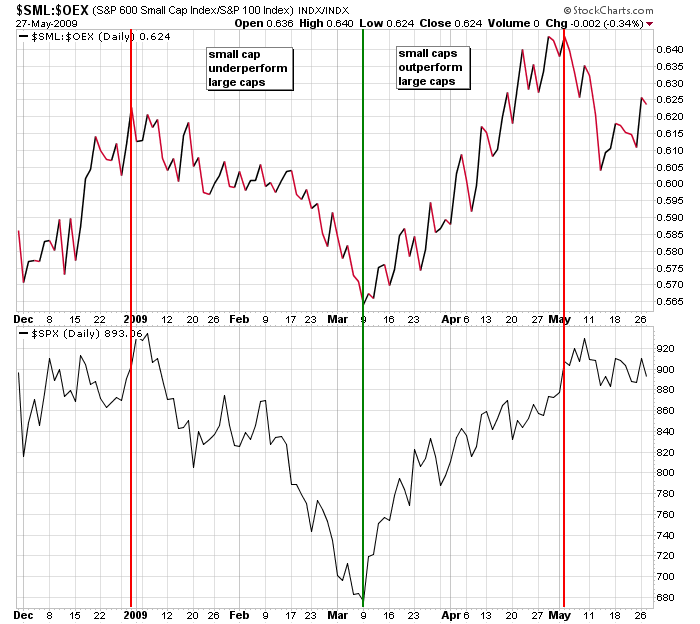

On Tuesday I mentioned some of the internal breadth indicators I follow are breaking down. Here are several of them.

Here’s the Advancing – Declining Issues at the NYSE, Nasdaq and Amex. Each have broken down from consolidation periods.

Here’s the Advancing – Declining Volume at the NYSE and Nasdaq. Each have broken down from consolidation periods.

The 31-period TICK on the 60-min chart has been trending down (a lower high and lower low is in place).

The small caps are under performing the large caps. This is a sign of internal weakness and usually accompanies weakness.

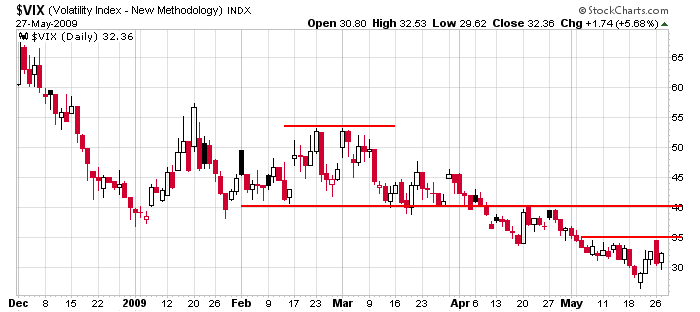

The VIX suggests complacency – a lack of fear. But if the index moves above 35, the market will sell-off.

Have to good day.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases