Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific market closed mostly up. Hong Kong rallied 3.1%, Australia, India and South Korea more than 2%, Japan, New Zealand, Singapore and Taiwan more than 1%. Europe is currently mixed; there are no big winners or losers. About 35 minutes before the employment numbers were released and 95 minutes before the open, futures here in the States pointed towards a relatively small gap down open for the cash market.

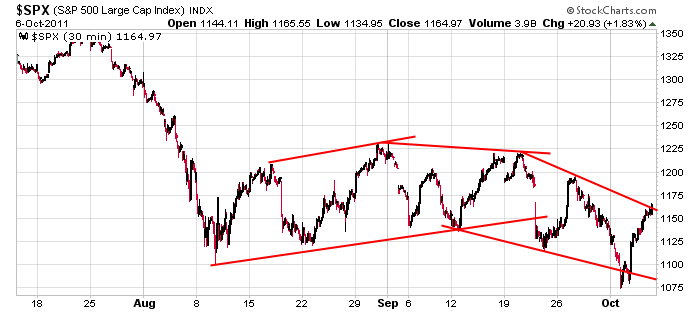

It’s been a good week for the market so far. It was weak Monday and early Tuesday and has been steadily moving up since. Currently the S&P is up about 3% on the week and is about 90 points off Tuesday’s low. For now I’m still calling it a bounce within a downtrend. If the market wants to prove me wrong, fine, but until it does my long term bias will be down. Here’s the 30-min S&P chart. After the big drop, we got a series or higher highs and higher lows and now a series of lower highs and lower lows. Monday’s loses, which closed the index at a new low, were recovered Tuesday, so other than that day, the S&P has remained range bound.

Here are the employment numbers:

unemployment rate: 9.1% (from 9.1%)

nonfarm payrolls: up 103K

private payrolls: up 137K

average workweek: up 6 min to 34.3 min

hourly earnings: up 0.2%

The S&P futures jumped about 15 points when the news hit. The first couple days off a low are the easy ones. The bulls get excited about buying at lower prices and the shorts cover. But those first couple days are over. Now it gets tough. Short term I remain in want-and-see mode and am in no hurry to re-enter the market. The market has some proving to do. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Oct 7)”

Leave a Reply

You must be logged in to post a comment.

same goes for me—–wait and see

if i was to short it would be the ndx100

it made a clear wave 1 down–aug low

and a 618 fib wave 2 up–finished

charts look like houses that we may put the bulls for winter

ESZ1 1d1m: Hmmmmmm, at 8:30AM ETZ the jobs report came out and the market spiked 15 points in 1 minute. At 9:30 AM ETZ the market is back. Since it took an hour to go down I’m taking that as no real selling pressure.

More than likely people will start booking profits later this afternoon.

I just bought 5 Nov puts on GS, just a long shot to keep my mind active

that’s all. But I do see a pullback, especially in the Rut after a

big move to the upside. HW

That would be a reactive sell-off. It seems the only movers trading today are the Nervous Nellies.

Doesn’t seem to be any buying pressure either other than the 8:30 ETZ Jobs Report. So the market is news driven today .

I was reading on one of the other blogs, one guy called Astrotrend.

He says the market is going sell off after 12noon today. 2) So far

I’m looking pretty good on my GS Nov puts. 3) By the way, the up

move today was probably around 50% short covering IMO. I am not

a technical analyst by any means at all. I follw the MACD’s on

the 30min and 60min SPY’s to give me direction. This way I

don’t get involved with too much Elliott Wave theory.

If you look at the 30min and 60min charts you’ll see

what I am talking about. HW

That’s a reasonable guess, it’ll sell-off around noon.

You’ll see thirty times more on a one minute chart.

after a spike high europe closed almost flat

euro just had big spike down on moodies downgrades on europe countries and earlier on europe banks

no buyers/sellers and pos doji close as its held flat for a asian sell off mon as china come back from week long holiday and the usa bulls get traped

with the euro droping the way it is on downgrades of italy/spain/portugal

a spx close of 1130 or 1160 would sound reasonable–currently its at main piviot

I’m watching SPX 1150 area with great interest. I’ve noticed that SPX has traded above the 13 & 20 day EMAs (1151 & 1158) which have turned up ever so slightly. A move below 1150 which then becomes resistance up to 1160 could indicate this rally from 1075 is over. I note NDX has failed yesterday and today at its 50 day EMA & RUT is close to forming an outside day to the downside today. All of this indicates to me that this rally is showing potential signs of rolling over. I’m looking for downside confirmation on a failed rally attempt.

PeteM & Aus, you two make a good argument for shorting the market. I think I’ll go long. I just don’t see the selling pressure. Granted it’s going down today, but look at how long it’s taking. If you discount the 8:30 Jobs spike it’s only droped 10 points. There is just no selling pressure today. I’m going long 1 over the weekend.

RichE – Just to clarify my comments – I’m not advocating a short position unless I see confirmation based on my technical analysis. You are correct, in my opinion, that the action so far is showing corrective action of the rally from 1075, implying the potential for further upside. However, because we are in a resistance area I projected AND the longer term trend is DOWN, I’m looking to position my last 1/3 short position IF I see a break of 1150 AND/OR a failed rally attempt in the 1163-1165 area.

Also, I’m positioning on the sell side for a longer term trade and wouldn’t go long here. I assume you’re talking about a long position from a daytrading perspective.

Yes, daytrading perspective, but this would be an overnight(weekend) trade.

i didnt trade today–just couldnt psyc myself up even though a few good 1 hour trades

plus i dont know what is happening—but feels strange to me

i dont see commited buyers or sellers

lets see what asia does–but it did give us a up 60 days

so perhaps the weekly opts ex traders know