Good morning. Happy Friday. This week has flow by. I guess that’s what happens when it’s holiday shortened.

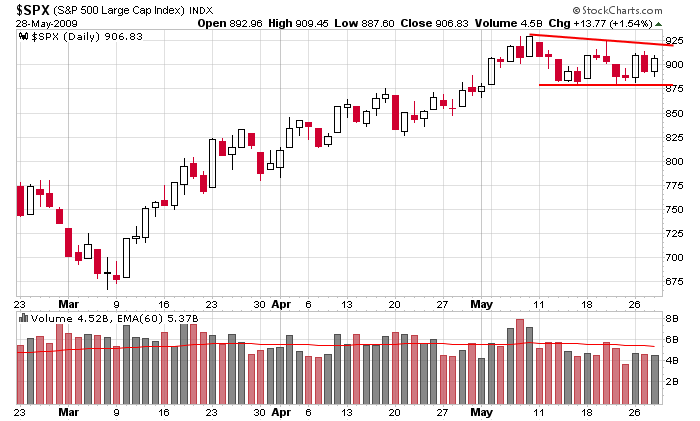

We had a big up day Tuesday which recaptured 4 days off losses…a decent down day Wednesday which almost gave back those gains…then an up day yesterday. Now we’re looking at a gap up open in the neighborhood of the intraweek high. Rallies get sold; sell-offs get bought. The price action is getting compressed; pressure is building. For about a month, we’ve gotten lower highs and higher lows. This type of action typically leads to an explosive breakout, so I’m thinking any target which is relatively close to the range is unrealistic. The market will either bust out and run or bust out and reverse soon after and run in the other direction.

Here’s the daily chart. If we back the chart up, I’d still consider the overall trend down, but taking a 3-month look, the chart looks fantastic…a steady move up for 2 months and now a month of consolidation. From a technical standpoint, this is bullish set up.

I know there’s a long list of reasons the market is supposed to go down and it very well may. The best advice I can give you is to trade what happens, not what you think should happen or want to happen. Otherwise you better have deep pockets and the ability to sit tight and wait. I promise whatever bets you place will eventually be winners – if you have the ability to wait long enough (just don’t play those ultra ETFs).

Have a great day. Enjoy your weekend. I see no reason to be super aggressive here. But be ready just in case the market busts out. It may be coming soon.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

yesterday’s leaders & laggards

this week’s earnings & economic releases