Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Hong Kong and Japan dropped more than 2%; Indonesia, South Korea and Taiwan fell more than 1%. Europe is currently up across the board. France is up 2.4%; Austria, Belgium, Germany, Norway and Stockholm are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

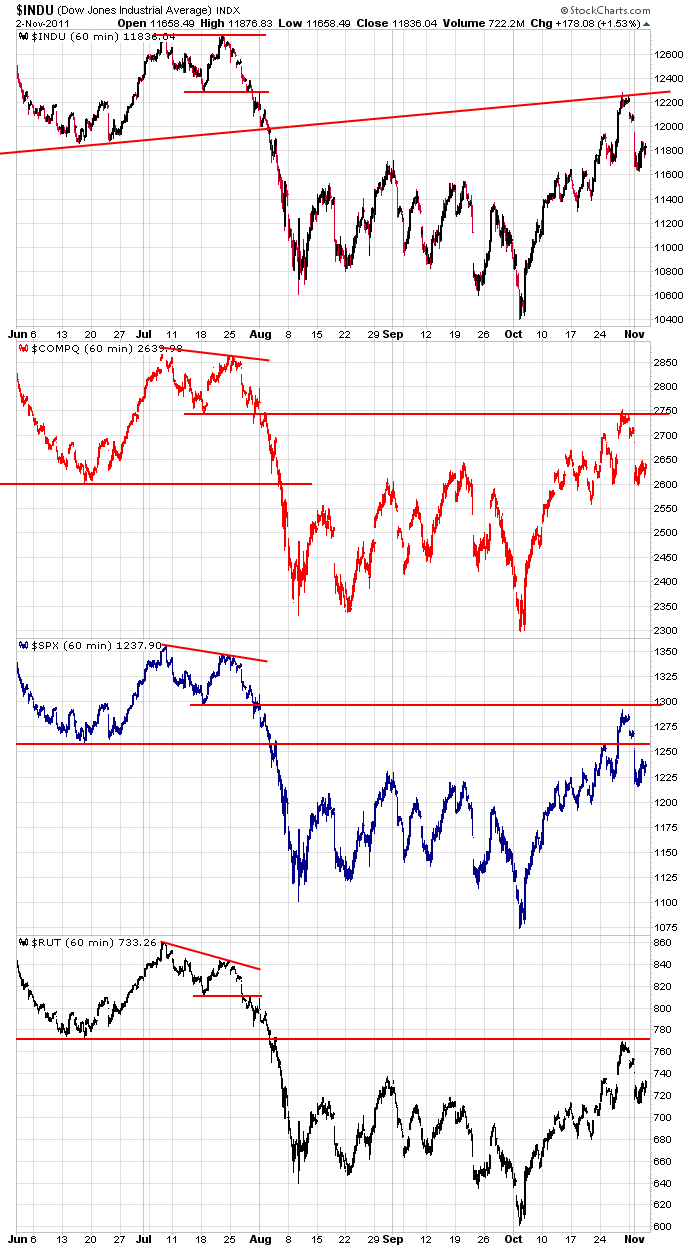

The Fed did their thing yesterday, and the market pretty much ignored them. They’re not front page news right now, and they’ve done a good job communicating their thoughts. Sometimes nothing major is going on in the world so less significant news items can influence prices day to day (although the trend typcially stays in place). Such isn’t the case. The financial situation in Greece and Europe is the only thing that matters. It trumps everything else, and until is cleared up, nothing else matters and the market will be held hostage. A big gap up or gap down can come on any day. Trading is rarely easy, but it’s not terribly hard if you trade good set ups under very good conditions (conditions are almost never perfect). Right now conditions are not good. There are too many headwinds. Here are the 60-min charts I’ve been posting for the last month. The Dow got rejected by a previous support level. The Nas and S&P got rejected by the July low. The Russell got turned back by the June low (it was the only index not able to climb back into its Jan-Jul range).

Jobs report comes out 60 min before tomorrow’s open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 3)”

Leave a Reply

You must be logged in to post a comment.

I’d like to see the SPX gap filled in the 1252-1255 area and 1260 (the .618 retracement area from the sell off from 1292ish to 1215ish)tested. In my opinion, signs of a reversal from that level may be a low risk shorting opportunity. However, if there’s a pullback today from the early morning high first that finds support in the 1235-1239 area, it may be a short term buying opportunity.

So much of trading is based on trading style or upon the traders trade-time frame of preference. While I know support and resistence points on a longer-term, trading style such as intermediate or swing can be fruitful, it is often much easier to trade substantial profits on faster time frames (daytrades. While charts must be more accurate to trade the faster frames, it is a one-on-one, “in-the-now” trading method that will often produce substantil profits very quickly without a lot of and account-drawdown exposure. I appreciate your commentary as it provides a good look at the “bigger picture” and how that picture can factor into our perceptions of forces that drive the markets from day to day.

Pagan Pete the Day-Trader, nice ring. Speaking of rings, as in Morning Bell, the Bear Volume appears to be greatest, but I feel the last few days are making a Bull Flag therefore today will be a post Halloween freaky tumble collecting Bear Suited trick-or-treaters and the squeeze’s short covering volume will pop the SPX over 1260. That’s my four day forecast.

So far today, SPX 1235 proved to be support and I’m long at 1238. I’m giving it some room but I’ll cover at 1240 & raise it if I see a new daily high. In the back of mind, I see a strong case developing to label the move down from 1292 to 1215 as impulsive. The rally from 1215 is more clear, in my opinon, i.e. it’s corrective of the move down. What this implies to me is that we may see a further move down below 1215 at some point, prior to any attempt to take out 1292.

By the way, The daily MACD (which I should pay more attention to and maybe less to EW)has been a reliable indicator at the turns. I’ve been using a daily MACD (13,20,9)on stockcharts.com and I see a turn down & showing just a tiny bit negative. I think it bears watching if this SPX rally fills the gap I mentioned earlier and starts to roll over in the resistance area I define as 1252 up to 1260.

Right about now the Bears s/b a rousing.

The influence of Jason, AussieJS and RichE has prompted me to cover my long position at 1249 and take a profit when it’s there – like a good daytrader. Thanks guys – I think!

I’ll wait to see if a pullback finds support at SPX 1241-1244 and maybe consider going long again. If we go to new highs first I’ll abstain from a long position and look for a failure in the 1252-1260 area to get short.

I guess the Bears aren’t hungry this lunch time. Oh well, I am. Later.

OK! As far as I’m concerned, we’re in the zone of reisistance in SPX, having filled the gap and now I’ll look for a test of 1260 or any sign of a failure or reversal from current levels or higher. Too late to get long in here in the shorter term, in my opinion.

After 3 attempts to break above 1260, I’m short at SPX 1258 and will cover quickly on break through of 1260.

Since 1:45, SPX has gone range bound between 1256 & 1260. I’m moving my buy stop to breakeven at 1258.

looks like everything–europe ect has covered its gaps

but may not pull back till tomorrow with today a exhaustion

unless we expect new highs or a last minute drop

I’m keeping my mouth shut since I blew the last one. This market is more Bullish than even I thought. There is no reason for it to go up like this. Well, no reason now, but in six months the Talking Heads will have several reasons.

I’ll be out-of-pocket tomorrow. See you Monday.