Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Japan and South Korea gained more than 2%; Australia, China, Hong Kong, Indonesia and Taiwan rallied better than 1%. Europe is currently mixed. Amsterdam is up 1%; no other index has moved 1%. Futures here in the States point towards a moderate gap up open for the cash market which will put the S&P above yesterday’s high.

The dollar is down. Oil and copper are up. Gold is flat. Silver is down.

American Airlines’ parent AMR has filed for bankruptcy. They want to restructure things to cut costs. For example AMR is the only airlines that still funds employee pensions and therefore has higher operating expenses than its competitors.

News hit yesterday that a European rescue plan was in the works. Today Italy had to pay more than 7% to auction its debt. Not good, but not as bad as it could have been. Italy still has access to capital. Also France’s AAA credit rating is at risk of being lowered.

Yesterday’s big gap up was a swift reminder we are in a period where anything goes. Europe controls things, and based on news, the S&P can gap up or down 50 points on any day. Most of the time we get some nice intraday swings to keep day traders happy, but swing trading comes with added risk. A nice gain can be wiped out fast. I’m continuing to play it safe and be conservative. When potential market moving news lingers and the chart are not permitted to play out as they would should the normal forces of supply and demand be in effect, I lay low.

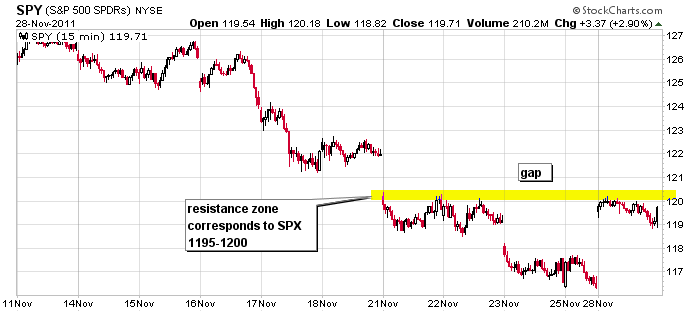

Here’s the SPY 5-min chart. There’s a resistance zone just above yesterday’s close that corresponds to SPX 1195-1200, and then there’s a gap above that. As of now, today’s open will be in the middle of the zone.

Let’s see how things play out today. I think things will clear up a little soon. More after the open.

headlines at Yahoo Finance

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Nov 29)”

Leave a Reply

You must be logged in to post a comment.

Jason’s SPX 1195-1200 resistance area (the 10 day EMA = 1199) has to be overcome and become support before a test of key 1212-1215 (the 20day & 50 day EMAs) can be expected.

From an EW perspective, my assumption is that we’ve completed a minor wave 1 from FRI’s low and we’ve either completed a minor wave 2 or we’re still in minor wave 2. Any test of 1212-1215 should come with strong contiued momentum if it’s to be a minor wave 3 of 5 waves. Otherwise, it will be suspect as a corrective 3 wave (abc) pattern from FRI’s low.

I went long at 1188 before yesterday’s close on a move up from 1184, thinking we were in a potential minor wave 3 to the upside. Now, we’ll see.

By the way, the reason 1215 is a crtical area (besides being the 50 day EMA resistance) is that many EW followers, who are mucho bearish, are seeing the downward move since SPX 1277 as a minor wave 3 within a larger wave 3 structure of a bearish 5 wave downward wave structure. A move above 1215 makes that count questionable.

I’ve been working under the assumption that, since the MAY high, we’ve been in 3 wave patterns (ABC) downward and FRI’s low may have completed a 3 wave pattern, leaving the potential for a sharp (Santa Claus) rally to the 1236 area where the real shorting opportunity may exist. As I said, now we’ll see.

“Europe controls things” I disagree. I’ve noticed a change in the SPXEUR/USD, the EUR is now reacting to the SPX. Make sense since the EUR is going to print money and the USD already has AND the European politico is showing its custodial acumen while the US politico has proved it’s inept.

My prediction: the SPX is going up. Business is going to take over.

I’m looking for a move to new intraday highs soon or I’ll cover my long position at or around 1197.

Well, I’ve covered my SPX long position at 1199. We’ve bounced around either side of 1200 for over an hour and I’ll look for a test of 1195-1197 to see if it holds. I’d like to get long again.

ESZ1: I’ll be going long if the next dip is above 1200.

RichE – May I join you?

You can join me, but 1200 didn’t hold. Looking at 1197.50

Maybe we need to see SPX test the 1197 area, or even lower down to 1185ish, unless today’s open around 1192 can hold.

my negative tick tells me this is again distributive not accumulative

the santa instos are giving out their presents to the unsuspecting

AussieJS – But, if SPX continues to drift sideways to down, my opinion is that it’s consolidating yesterday’s advance and then will continue higher to at least test SPX 1215. In the broader time frame, I agree that this will turn into a longer term shorting opportunity, but from what level? SPX 1215, 1236, or maybe even higher?! I just can’t rule out another surprising upside rally, even though I’m bearish.

Hell, if they can rally a market on the excuse that consumers are really, really loading up on gifts (on the credit card?) and Europe is gonna find a way to kick the can further down the road, they can rally it on anything, e.g. ISM report less bearish than forecast, etc.

I’d like to see what happens if SPX gets to 1190ish. I’d be inclined to get long if it holds with a nice upside reversal.

ESZ1:long @ 1194.50

And I’m long at SPX 1196. But, I need to see some upside momentum building pretty quickly to stay in.

We need to see SPX get on top of 1200 and then see it become support to make me feel like holding on.

Out @ BE. Yep, we need momentum.

Where’s the upside momentum and acceleration? I’ll make it easy for myself and cover at breakeven now that we’re past 3PM.

Due to a lack of upside follow through, I’m out of long SPX at 1198.

Looking at the SPX hourly chart from an EW perspective, we are either in a sideways, flat minor wave 2 correction, having completed minor wave 1 yesterday or, yesterday’s high was wave “a” of and abc pattern and we are forming a sideways wave “b”.

I’m now inclined to think that we need to go lower to the 1184 area if my “flat” interpretation is correct. There’s an alternative very bullish short term interpretation, but that would require support to hold above 1192-1194, i.e. a “running” minor wave 2. Maybe we find out tomorrow.

well sub 4 of 1 is finished imo

the mutuals wanted their bonuses and sometimes the last day of month they dump

out with the junk–down with the suckers rally—the vix is still above 29

ESZ1: The steam went out of the market. Oh well, I’m short 1 @ 1199.25 going to leave it overnight.

See ya tomorrow.

PeteM, if you got the time, do a compare of EUR/USD and ESZ1 60day 60minute. They’re the same until around 11/1 then they change. It’s not the same with the other indexes. Adding a fib (10/4 to 10/27) makes it more interesting. They seem to be reversing at the same time but different levels.