Yesterday six central banks announced coordinated effort to provide liquidity to the global financial system. Check out this press release. Does it sound familiar?

Today, the Bank of Canada, the Bank of England, the European Central Bank (ECB), the Federal Reserve, the Bank of Japan, and the Swiss National Bank are announcing coordinated measures designed to address the continued elevated pressures in U.S. dollar short-term funding markets. These measures, together with other actions taken in the last few days by individual central banks, are designed to improve the liquidity conditions in global financial markets. The central banks continue to work together closely and will take appropriate steps to address the ongoing pressures.

But this release wasn’t from yesterday. It was from September 18, 2008.

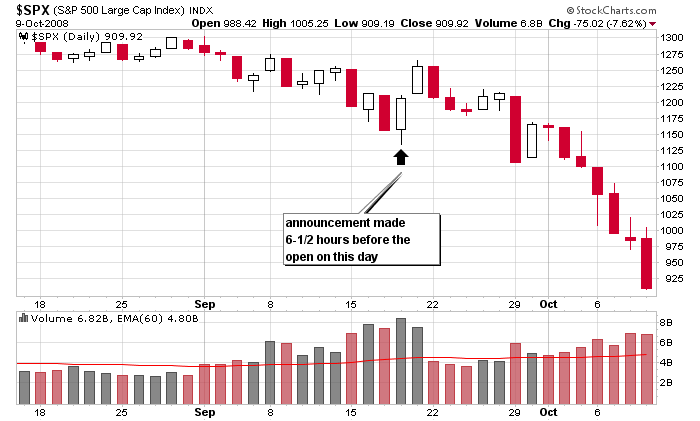

Here’s the chart from that time. The S&P jumped 100 points in two days…then got clobbered. I’m not predicting anything here…just reminding you to keep an open mind.

0 thoughts on “Deja Vu?”

Leave a Reply

You must be logged in to post a comment.

Very very nice. Thank you for finding the information and chart.

With one exception….the timing today was in synch with the Christmas rally of 2011. HW/nyc

That’s all i’m hearing, all negativity,and–they could be right, but i’m not sitting on the sidelines. I know where my stops are, just like the 2008 chart. What could happen–catch a nice rally and make some coin (look at goog–aapl–mt–rig–etc. many co’s. heading higher.

Trade em, or sit and woryy about what could happen. Hey, they could get clobbered, so one takes some losses–that’s trading, but this could present a heck of a rally that i’m willing to bet on. Happy trading !

I agree that the coordinated effort by the central banks may not portend a bull market.

However, as discusssed by Dennins Gartman in numerous venues, the biggest news that moved the market was the Chinese authorities decreasing the margin requirements for Chinese banks. In Gartman’s words, “it is like taking a 2×4 to a mule’s head, and history has shown that one cut in margin requirements is followed by further cuts.” The second largest economy in the world (China) has its government easing monetary policy as fast as it can; and the Chinese move will have the longer term effect.

I still think the news from Europe is bigger and more important. Whether China grows at 6% or 7% next year matters much less than if Europe totally collapses (which is what would happen if the central banks didn’t intervene). JMO