Good morning. Happy Thursday.

The Asian/Pacific markets closed down across the board. China, South Korea and Taiwan dropped more than 2%; Australia, Hong Kong, Indonesia, Japan and Singapore dropped more than 1%. Europe is currently mostly up. Germany, France and Norway are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up small amounts.

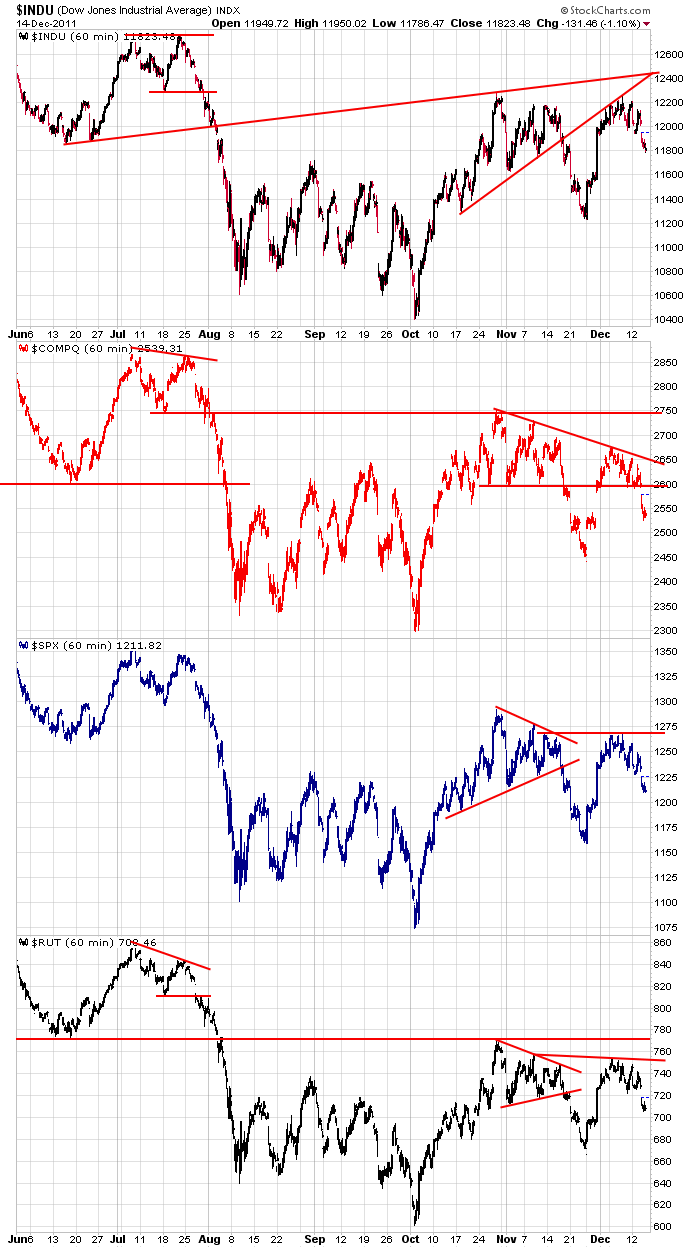

Here are the 60-min index charts. Prices are currntly smack in the middle of their late-Nov lows and early-Dec highs. Prices are also unchanged since the first week of Aug. For all the up and downs and large opening gaps and news, the market is simply flat. There are lots of opportunities to make money day trading, and if you’re a longer term investor who likes to collect dividends, you’re doing just fine – a flat market while you get paid every month or quarter is a perfectly fine scenario. But for those that like to buy and hold for a couple weeks or a month, trading has been frustrating. Lots of gaps, lots of sudden reversals, very little follow through. Other than October when we got a 1-month rally, we’ve had to keep our holding times shorter than we’d like. Oh well. That’s just the way it’s been, and there’s no sense arguing or complaining. The trading environment will get better. In the near term your job is to preserve captial, so when a better environment arrives, you’ll be ready to roll instead of having to dig out of a hole. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 15)”

Leave a Reply

You must be logged in to post a comment.

does anyone see the rounding tops –bearish–and below resistance in all of Jasons charts

Yep, saw that yesterday, looks like their making, ‘Swan Dives’, but my gut is telling me too much Christmas candy and be careful about shorting. I’m short at the moment. Target 1210 ESH2.

The EUR/USD is trading at 1.3011; (1.3000) is spiritual. “Will it hold? Will it hold? Will it snow?

My guess; the USD is getting stronger which will cause commodities to be more expensive and the biblical swarm of hyper-inflated locus will devour the manmade wonders of planet earth.

Geez! Where did that come from? Maybe I should buy my Goth GF an elf outfit.

BTW: still short, but watching 1200 ESH2.

u may have frightened the markets ,Rich———they cant seem to hold any sort of a rally

yep, I’m a market influence, Bulls, Bears and Locus.

ESH2 intraday: looks like a HS from 6AM. RS should fail big time as the locus darken the market sky. Adding to short position.

Rats! EUR/USD isn’t failing.

There it goes.

i use the ZE Z1 emini euro on esignal as its the only one i can get with my emini package

but i have the =usd and the eur= live cash on another computer

they are not always reliable for equities as a ind and sometimes a delay

but u sometimes also get divergences—so it give a fairly good ind

Agreed, good, but tricky to read.

Darn it, it just won’t mind. I believe this is one of those ABC things that should resolve to the downside otherwise I’ll be in the hole.

Based on my interpretation of EW, I’ve taken a short position at SPX 1221 in the expectation that small wave 4 (of a 5 wave downward pattern that began yesterday at 1250ish) has ended. I’d want to see 1218 broken initially to stay short.

Yep, and EUR/USD is trading @1.2998

If SPX doesn’t break down soon, I’ll cover my short position and consider a long position on a break to the upside. It’s possible that yesterday’s last hour low was a 5th wave down, completing the correction from 1266.

Keep your powder dry Hoss!

ESH2 finally hit 1210 but the EUR\USD is trading above 1.3000. The EUR/USD needs to cave.

1209 1.3007

Pete:

I day trade using trend lines and oscillators. You also day trade.

I am familiar with Elliot Waves but certainly no expert.

You stated yesterday that you use the 60 minute charts. And I stated that I use the 2-4 minute chart.

I believe that Elliot Waves might help with my trading, but I am wondering if you use the 60 minute chart to count waves or different time frames to count waves to determine your day trading entries and exits?

Thank you in advance,

Kezha

Darn ABC’s. Darn Eur pride. Throwing in the towel.

It has been a REALLY tough day to trade…PERIOD. Don’t beat yourself up. I have sworn at Europe myself the past few months. Seems the best time to trade is around 3;30 am CST until just before the open in the USA.

Covered my short position at 1218 and I’ll stand aside watching 1222 & 1215.

Kezha – I use the 60 minute chart to try to ascertain the possible wave structures. I use the 1,3 & 5 minute charts to look for entry/exit points. Like you, I also use oscillators, trendlines and Fibo relationships to help confirm what I think I’m seeing.

Also, I prefer to take longer term positions. My day trading recently is based on Jason’s sound advice that there’s an absence of longer term trends recently. I’ve been day trading with the hope that one of my positions will evolve into a longer term trade. Because I use tight stop loss discipline, I’ve gotten out of my positions on an intraday basis recently.

Thank You !!!

I shall take a look at it tonight and see what I come up with. I was a subscriber to Jason’s excellent site for (I think) a few years. I learned a LOT, but he basically introduced me to the emini futures. Before that I was day trading the QQQQ.

I presently trade combination of trend line, CCI settings, MACD settings, and RSI settings. Prior to that (when I was on Jason’s board), I posted charts using 4 CCI settings. A 20, 40, 180, and 240 setting. It seemed to work fairly well. A member of the board posted that the CCI 180 and 240 setting gave a long term direction while the 20 and 40 were more momentum. If I could get a signal from a long and short signal I would get a change of direction with momentum.

It worked…with about a 70% chance of success and I exited at the drop of hat if it turned against me. So, I made money when it worked and kept my losses to a minimum.

I remembered what that person had said, and then developed a different system using the same concept with the indicators I posted above that I now trade with.

Thank you for you information. It is GREATLY appreciated and Happy Holidays to you.

Kezha

PeteM..please continue to post. Your posts are very helpful to me and I’m sure others as well….you seem to be a very good ewave practioner.

Thanks

Yes, it is VERY rare when you find people in this business who will share their trades in REAL time for all to see. I second Mr. Gordon’s comments.

Chris & Kezha – thanks for the kind words. I’ll conclude my thoughts by saying that, since I began trading in the early 1970s, the learning process never ends. There’s no holy grail when it comes to technical analysis. The best advice I ever got was to make sure you manage risk through trading proper size and use of stop loss management. Some traders can use mental stops but I learned the hard way that I’m not one of them. We all run hot & cold with our trading techniques, but the key to my hanging around for 40 yrs was finally learning to control losses. That’s why I think Jason offers such consistently sound commentary. While I don’t subscribe to his service, he provides the opportunity for all to comment. More people like you should comment on your trading techniques because we’re never too old to learn.

this may be a little late for most

i found the last few hours or from noon to sideways small range to trade so fell asleep

just wanted to say Kezha—sounds like u trade the europe open to usa pre open

if so u should have the ftse and dax charts open as ur guide—i trade that time frame and it is clearer to read—but u have to watch out for news item and market announcements

Thank you,

However, here in the States, I can go to Yahoo finance (and other sites) and see the economic calendar. The CME also has the calendar of market announcements (CPI, Unemployment numbers, etc.)

I have yet to find a GOOD one for Europe.

Any good suggestions on websites?

Thanks in advance.