Good morning. Happy Wednesday.

So the Wild Wild West continues on Wall St. Every day we get a big gap – some fill the same day, most do not. There are lots of random intraday moves – no rhyme or reason. Technical analysis works best when news is scarce and the forces of supply and demand can be formed by millions of traders/investors all over the world analyzing the market in their own way. Greed, fear, wishes, wants and desires all play a role. But when the market is held hostage to every wink, nod and smirk out of Washington, the natural forces that exert themselves get jerked around.

America is great because we have rules, and while we may not like the rules, it’s better to know they exist so we can plan around them than to not know what they are or to know they can change any time. Right now Washington is making things up as they go. They aren’t following any precedent. They aren’t following the rules in place, so no one knows what they’ll do. Why was Bear Sterns saved but Lehman permitted to go under? Why are BAC and C still in business when dozens of other banks have been taken over? Why is AIG still in business? Or at the very least, why do the shareholders and creditors still have value?

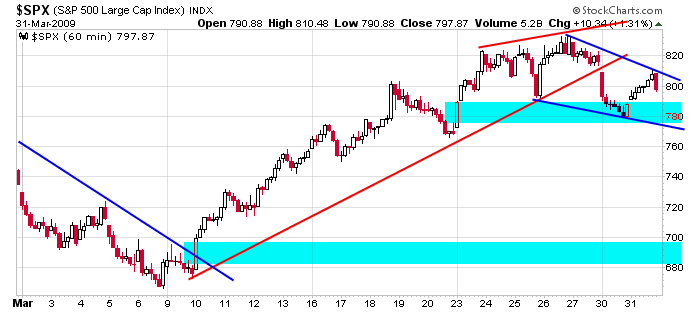

This is the market we’re dealt, so this is the market we’ll trade. Here’s the 60-min SPX chart. The index broke down from a rising wedge and is now trading in a falling wedge.

Heading into last week I said the market was overbought and in need of a either a wicked pullback or some sideways trading to allow the overbought readings to reset because there was too much fluff out there. Since that time the market went up and is now coming back down. Overall it’s up a little, so although zooming in reveals lots of erratic movement, panning out reveals a market that’s just working off an overbought condition.

Strong markets embrace good news and ignore bad news. This was the market’s character in early and mid March but not any more. The market is falling on bad news. Wanna know when/if the market will leg up again? When bad news hits and a rally follows, we may actually be able to hold for more than a day or two. Otherwise, we’ll go back to shorting.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

earnings & economic releases