Good morning. Happy Thursday.

The Wild Wild West continues on Wall St. Including today’s big gap up, this will be the 9th consecutive day the market gaps big at its open – 5 have been up, 4 down. Some fill the same day, some do not. Throw in all the sudden and large intraday moves which seem to happen for no reason and Wall St. resembles Vegas more than it resembles a marketplace where traders/investors come together to buy and sell shares of stocks.

As of yesterday’s close, the market was up slightly over the previous two weeks. Volume has been greater on the up days than down days, so the overall action has been constructive – albeit somewhat frustrating for swing traders who have to deal with all gaps and noise. And research has revealed many more bullish charts than bearish.

Almost two weeks ago I said the market was overbought and in need of some weakness to work off some fluff. The process is still playing out.

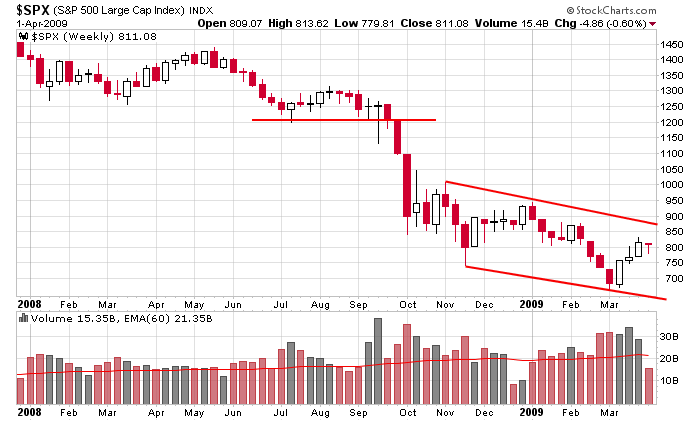

Here’s the weekly SPX. If I had to pick a target for this move up, I’d loosely put it between 850 and 875 – the top of the channel.

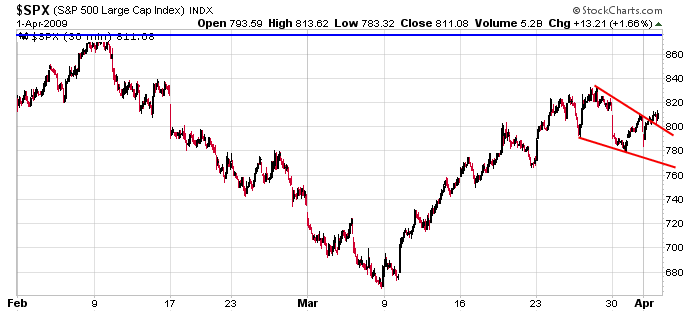

Here’s the 30 min chart. The Feb high is around 875.

Trading at the beginning of Mar was very easy – lots of great breakouts and an obvious trend to play. The last two weeks have been challenge. Swing at good pitches only. There’s nothing wrong with standing there with the bat on your shoulder if you’re not sure.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases