Good morning. Happy Friday. Happy Jobs Report Day.

As stated yesterday, in my opinion, the charts of the indexes look good and the charts of select individual stock are trading well, but the internal indicators are overbought and in need of a pullback. This weekend I’ll be doing a video summarizing many of the indicators I’m looking at and why I believe one or two things is happening right now. Either the market is undergoing a character shift or it’ll sell off relatively soon.

Unemployment numbers are out. I don’t have time to look through them in detail because I want to post this and send it out. I can say the market reacted positively to them. This could change. It’s not uncommon for the futures to move in one direction after the news and then reverse everything by the opening bell.

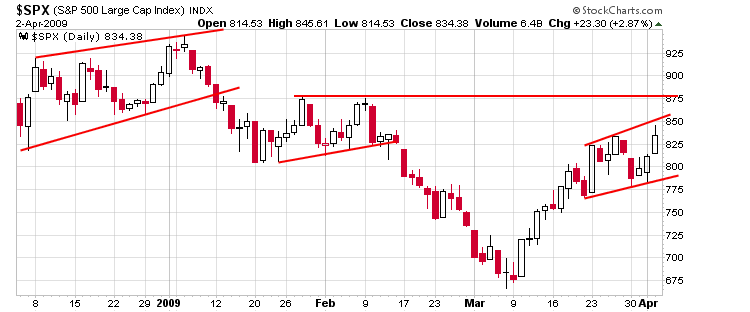

Here’s the SPX weekly. Our first target at 850 was missed by about 5 points yesterday. Volume is declining – that needs to be noted. And barring a big sell-off today (it’s possible), we’ll have our first 4-week winning streak since Sept 2007.

Here’s the SPX daily. First target is also 850, and I think a parabolic move to 875 will be a great shorting opportunity.

headlines at Yahoo Finance

stocks to watch MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases